Tennessee Business Name Search

Selecting the right name is an essential first step for your Tennessee LLC, requiring you to ensure the name’s availability. This process is vital to avoid infringing on existing business names and intellectual property rights within the state.

Our Tennessee LLC name search guide offers essential tips on checking LLC name availability in Tennessee, reservation, and registration, helping you secure a unique and compliant business identity efficiently.

How to Look Up an LLC or Any Business Entity in Tennessee (Summary)

To look up an LLC or any business entity in Tennessee, you can follow these steps:

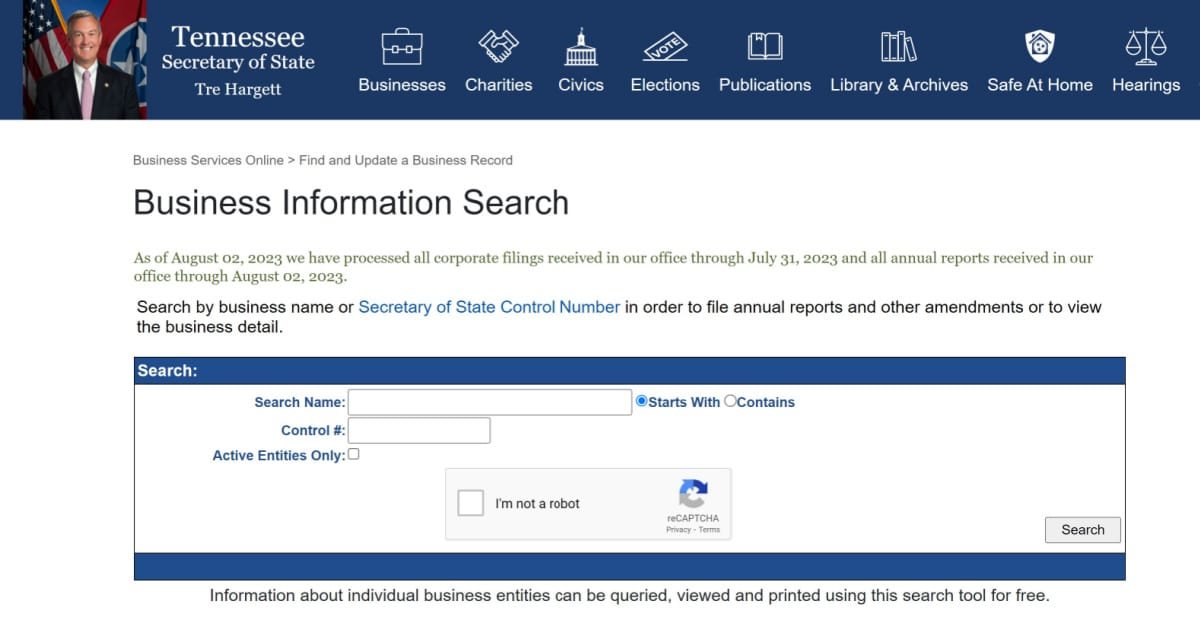

- Visit the Tennessee Secretary of State website.

- Click on “Business Services” in the top menu bar.

- Select “Tennessee Business Name Availability Search” or “Search Businesses” from the drop-down menu.

- Choose the “Search by Business Name” option.

- Enter the name of the LLC you are looking for in the search bar.

- Review the search results to find the LLC you are looking for.

- Click on the name of the LLC to view its business information, including its status, registration date, and registered agent.

Tennessee Secretary of State | Contact Information

Mailing Address

Business Services

Tennessee Secretary of State

312 Rosa L. Parks Ave.

6th Floor, Snodgrass Tower

Nashville, TN 37243-1102

Physical Address

Business Services

Tennessee Secretary of State

312 Rosa L. Parks Ave.

6th Floor, Snodgrass Tower

Nashville, TN 37243-1102

Hours: Monday-Friday, 8:00 a.m.-4:30 p.m.

Email: TNSOS.CORPINFO@tn.gov

Phone: (615) 741-2286

What is a Tennessee Business Entity?

A Tennessee business entity refers to an organization that is legally formed and recognized to conduct business within the state of Tennessee. The process for creating and managing these entities is overseen by the Tennessee Secretary of State’s Division of Business Services.

The common types of business entities that can be formed in Tennessee include:

- Sole Proprietorship: This is a type of business that is owned and run by one individual. There is no legal distinction between the owner and the business, so the owner is personally responsible for the business’s debts and obligations.

- Partnership: This can be a general partnership, limited partnership, or limited liability partnership. A partnership involves two or more individuals who agree to share in the profits and losses of a business.

- Corporation: This is a separate legal entity owned by shareholders, which provides liability protection to its owners. It can be formed as a for-profit or a nonprofit organization.

- Limited Liability Company (LLC): This is a type of business entity that combines elements of partnerships and corporations, offering the liability protections of a corporation with the tax and operational flexibilities of a partnership.

TN Secretary of State Name Search

Each of these types of business entities has its own rules and regulations regarding formation, taxation, and liability. For instance, forming an LLC or a corporation in Tennessee involves filing the appropriate documents with the Secretary of State’s office, and may involve a filing fee.

Search Business Names in Tennessee (Tennessee LLC Lookup Guide)

Note that if the LLC is not registered with the Tennessee Secretary of State, it may be registered with a county or municipal government. In that case, you may need to contact the local government to obtain information about the LLC.

| Searching for Tennessee business names is done through the Tennessee name availability site. |

All companies that wish to do business under a different or assumed name in Tennessee must register their business name.

Choose a Business Structure

Before a name can ever be registered, it is necessary to choose a business structure. How the business is legally organized will depend on its structure. These are the four business entities:

- Sole proprietorship

- A general partnership

- Corporation

- Limited-Liability Company (LLC)

Remember that Tennessee does not have a standard business license for companies to file. However, some businesses may need permits from agencies or special licensing in order to open.

A majority of Tennessee businesses require an annual license issued by the county clerk. A license may also be required if the business is within the city limits.

Guidelines for Choosing a Name

Once the entity has been chosen, it is necessary to register the business name. You don’t need to file if you operate a business under your first name and last name, whether a sole proprietorship, general partnership, or general corporation.

A general partnership that operates under a different name must file a Statement of Partnership Authority.

An assumed name registration might be required if the business operates under a different name or DBA. This determination will be made by the register of deeds in the county where the business is located.

The Secretary of State must receive the Application for Registration Of Assumed Name if an assumed name filing is required.

These are some rules to follow when naming your business:

- Differentiable: Your name must be unique and cannot be used by other businesses. Use the U.S. Search Engine to check if your preferred business name is available. The TESS System of the Patent Office. Some counties require a physical form. Check with your county clerk or secretary of state’s office.

- No implications: A business name does not imply affiliation with government agencies or charities.

- Special permission to use financial terms: Tennessee demands that words like mortgage, credit union and trust cannot be used without the permission of the Tennessee Department of Financial Institutions.

How to file for an assumed name

You can register your company under an assumed name by creating an account at the Tennessee Online Filing System. You must include your full name, address, telephone number, desired DBA of the company, and complete address to the business.

You can mail the completed form to the address below if you prefer a hard copy. Include the $20 filing fee.

Corporate Filings

312 Rosa L. Parks Ave.

6th Floor, William R. Snodgrass tower

Nashville, TN 37243

Additional Steps

1. Trademark Search

When searching for a business name, it’s important to note that availability doesn’t necessarily mean the name is free to use if it’s already a registered trademark.

To avoid potential complications down the line, it’s wise to conduct a thorough trademark search using the Trademark Electronic Search System before finalizing a business name.

2. Choose a Registered Agent

After you have chosen an LLC name that is distinctive and unique, you can now choose your LLC’s Registered Agent.

3. Check if the Domain Name is Available

To check if a domain name is available, you can follow these steps:

- Go to a domain registrar website, such as GoDaddy.com or Namecheap.com.

- In the search bar on the homepage, type in the domain name you want to check.

- Click on the search button to see if the domain name is available or not.

- If the domain name is available, you will be prompted to purchase it. If it’s not available, the registrar will suggest some alternative options or you can try a different domain name.

4. Check if Social Media Name is Available

Check if a social media name is available for a new business name

5. Register Tennessee Business Entity

When you complete the required documents for filing a new business entity, you then register your business and business name with the state. The state of Tennessee will either approve your business name or reject it.

If you hire a good LLC service like Northwest Registered Agent, ZenBusiness or Bizee, these LLC services have business name tools available for you to do a quick search.

6. Register an Employer ID Number (EIN) With the IRS

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses and other entities for tax purposes.

7. Create a Brand Logo

Creating a business logo involves several steps. There are affordable online services that can design a logo for you and assist with the process.

Define your brand: Before you start creating a logo, you need to define your brand’s personality, values, and mission. This will help you create a logo that accurately represents your brand.

8. Write a Business Plan

Writing a business plan involves a comprehensive process that covers various aspects of your business, including the industry, market research, marketing and sales strategies, financial projections, and more.

9. Open a Business Bank Account in Tennessee

A bank account is generally required for a new Limited Liability Company (LLC) or corporation to separate personal finances from business finances and to establish a clear record of business transactions.

Note that the specific requirements for opening a bank account for an LLC may vary depending on the bank and state where you are located. It’s best to contact the bank you plan to use to inquire about their specific requirements.

Tennessee LLC Name Search FAQ

How can I verify if an LLC is registered in Tennessee?

To check if your business name has been taken out of the database, you can use the Tennessee Business Name Search Tool.

Find out more information about the availability of business entity names in the How To Search Available LLC Names section.

Do I have to name my LLC after me?

Although there is no prohibition against naming your LLC after yourself (most experts recommend against it).

An advantage of an LLC is that you can choose a different business name, which can make your business sound more professional.

What words are prohibited in a Tennessee LLC’s name?

It is not possible to include words in business names that suggest that the company is a bank or financial institution, or that it is affiliated with a local or state government agency.

Tennessee LLC names must not contain “corporation”, “incorporated,” or any abbreviation thereof.

Find out more information about LLC naming requirements in the Tennessee Naming Requirements section.

Do I need an LLC name generator?

An LLC name generator is a great tool to help you choose a name for your LLC.

What is a brand?

A brand name is a name that a company gives to a product line or product. It can be the exact same as the company name, or something else.

Our How To Name An LLC guide will help you learn more about branding your business entity name.

Do I need to include LLC in the name?

Yes, Tennessee law requires LLCs to use the “Limited Liability Company” abbreviation (e.g. LLC or L.L.C. in their legal name.

Find out more information about LLC naming requirements in the Tennessee Naming Requirements section.

Do I have to renew my Tennessee business name?

Tennessee does not require LLCs to renew their legal names; assumed names must be renewed every five years.

You can renew online, or by submitting form SS-4239 Renewal of Registration for Assumed Name. The filing fee is 20.

Is it possible for my business name to be different from the Tennessee LLC name?

Some companies prefer to operate under a different name than their legal name. It can be called either a “doing business as” (DBA name) or an assumed name in Tennessee.

LLC assumed names in Tennessee are filed with the Secretary of State.

Hi Brian, great article. I have a question, are there any other specific naming restrictions or guidelines in Tennessee that I should be aware of during my business name search?

Yes, Tennessee has specific naming restrictions and guidelines that you should consider during your business name search. The state requires that business names must be unique and distinguishable from existing entities. It’s important to avoid using prohibited words or phrases, such as those implying governmental affiliation or misleading terms. Additionally, if you plan to include certain words like “bank,” “insurance,” or “university” in your business name, you may need to obtain special licenses or permissions.

Brian, your article on searching for available business names in Texas is a great resource, because I’m in the process of forming an LLC in Tennessee right now. I appreciated your emphasis on creativity and the importance of choosing a name that aligns with the business’s mission and values.

Eric

Thanks Eric