Starting a Limited Liability Company (LLC) is one of the most popular ways to structure a new business in the United States. LLCs combine liability protection with flexible management and tax benefits, making them a strong choice for entrepreneurs across industries.

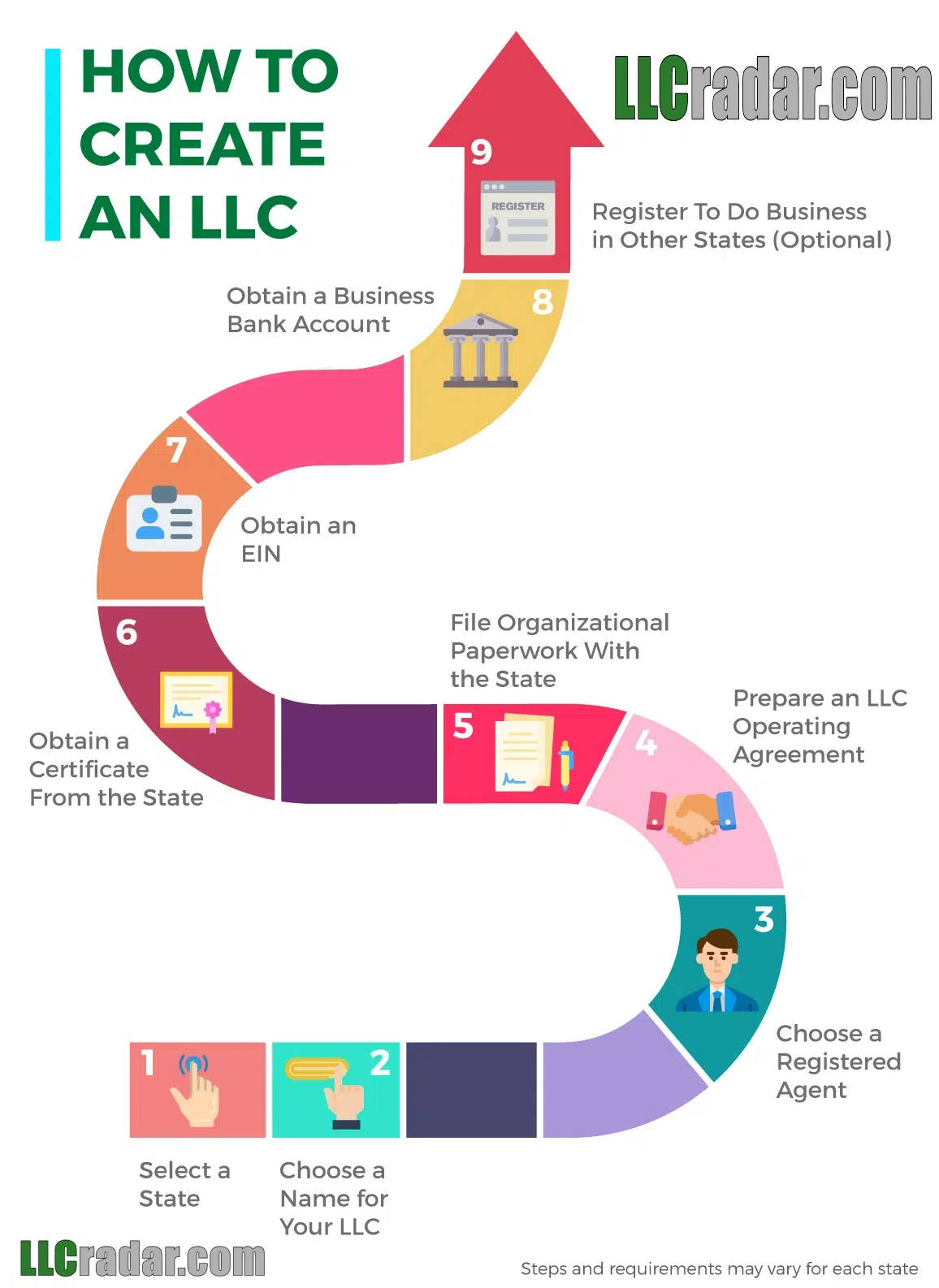

📋 LLC Formation Checklist

✅ 1. Select a State

– Choose your home state or a business-friendly state like Delaware, Wyoming, or Nevada.

✅ 2. Choose a Name for Your LLC

– Make sure it’s unique and follows your state’s naming rules.

– Search state databases and secure a matching domain name.

✅ 3. Choose a Registered Agent

– Appoint yourself, another individual, or hire a professional registered agent service.

✅ 4. Prepare an LLC Operating Agreement

– Outline ownership, management structure, and operational rules (recommended even if not required).

✅ 5. File the Organizational Paperwork with the State

– Submit Articles of Organization (or Certificate of Formation) and pay the state filing fee.

✅ 6. Obtain a Certificate from the State

– Receive official confirmation that your LLC is legally formed.

✅ 7. Obtain an EIN (Employer Identification Number)

– Apply for free on the IRS website to handle taxes and open a business bank account.

✅ 8. Open a Business Bank Account

– Keep your personal and business finances separate to protect your liability shield.

✅ 9. Register to Do Business in Another State (Optional)

– If you operate outside your formation state, file for a Foreign LLC registration.

How to Start an LLC: 9 Essential Steps

Step 1: Select a State

Your first decision is where to form your LLC. Most business owners choose their home state, but in some cases, forming an LLC in another state like Delaware, Wyoming, or Nevada offers additional legal or tax benefits. If you plan to operate primarily in one state, it’s usually best to form your LLC there to avoid extra registration costs.

Step 2: Choose a Name for Your LLC

Next, you’ll need to pick a unique and distinguishable name for your LLC. The name must comply with your state’s rules, usually including words like “Limited Liability Company” or “LLC.”

Be sure to check your state’s business name database to confirm that your desired name is available. You might also want to reserve the name if you’re not filing immediately, and consider securing a matching domain name for your business website.

Step 3: Choose a Registered Agent

Every LLC must designate a registered agent — a person or business entity authorized to receive legal documents on behalf of the LLC.

Your registered agent must have a physical address in the state where your LLC is formed. You can serve as your own agent, but many business owners choose a professional registered agent service to ensure compliance and maintain privacy.

Step 4: Prepare an LLC Operating Agreement

An operating agreement outlines how your LLC will be managed, how profits and losses are divided, and what happens if a member leaves the business.

Even if your state does not require it, creating an operating agreement is highly recommended. It helps prevent disputes among owners and adds credibility to your LLC’s independent legal status.

Step 5: File the Organizational Paperwork with the State

To officially form your LLC, you’ll need to file formation documents (often called Articles of Organization or Certificate of Formation) with your state’s business filing office, usually the Secretary of State.

This filing typically includes basic information such as the LLC’s name, registered agent, and management structure. A filing fee will apply, which varies by state.

Step 6: Obtain a Certificate from the State

Once your filing is approved, your state will issue a Certificate of Formation (or a similar document).

This certificate proves that your LLC legally exists and is authorized to conduct business. You’ll need this certificate to open a business bank account, obtain licenses, and handle other official business matters.

Step 7: Obtain an EIN (Employer Identification Number)

An Employer Identification Number (EIN) is like a Social Security number for your LLC. It’s required if you have employees, but even if you don’t, you’ll likely need an EIN to open a business bank account or file business taxes.

You can easily apply for an EIN for free through the IRS website.

Step 8: Open a Business Bank Account

Opening a dedicated business bank account keeps your company’s finances separate from your personal finances — a crucial step for maintaining your LLC’s liability protection.

Bring your LLC’s Certificate of Formation, EIN, and Operating Agreement when opening your account. Many banks also offer additional business services like credit cards and merchant accounts.

Step 9: Register to Do Business in Another State (Optional)

If your LLC operates in multiple states, you may need to register as a “foreign LLC” in those additional states. This process, called foreign qualification, typically requires submitting an application and paying a filing fee in each state where you operate outside your home state.

Frequently Asked Questions (FAQs)

1. How much does it cost to start an LLC?

The cost to start an LLC varies depending on the state. Filing fees typically range from $50 to $500. Additional costs may include registered agent services, name reservation fees, and state-specific publication requirements. It’s important to check your state’s specific fees before filing.

2. Do I need an attorney to start an LLC?

No, you are not required to hire an attorney to form an LLC. Many entrepreneurs file the paperwork themselves or use an online LLC formation service. However, consulting an attorney can be helpful if your LLC has complex ownership arrangements or if you want legal advice specific to your situation.

3. Can a single person form an LLC?

Yes, a single person can form a Single-Member LLC (SMLLC). This structure still provides liability protection and tax flexibility, and it’s a popular option for freelancers, consultants, and solo entrepreneurs.

4. How long does it take to form an LLC?

The processing time to form an LLC depends on the state. Some states offer instant or same-day processing for online filings, while others may take several days or weeks. Expedited processing is available in many states for an additional fee.

|

|

|