California, with its vast economic landscape, beckons entrepreneurs to mold their visions into structured businesses.

This article traverses the pathway of forming an LLC in the Golden State, emphasizing its unique regulatory nuances, the significance of each step, and the expected timeframes to ensure a successful and compliant Limited Liability Company inception.

How Long Does it Take to Get an LLC in California?

Approval Time for a California LLC

Online Filing: You can get an LLC in California in 3-5 business days

Mail Filing: Filing by mail can take about 3-4 weeks

California LLC Filing Steps

Online Filing

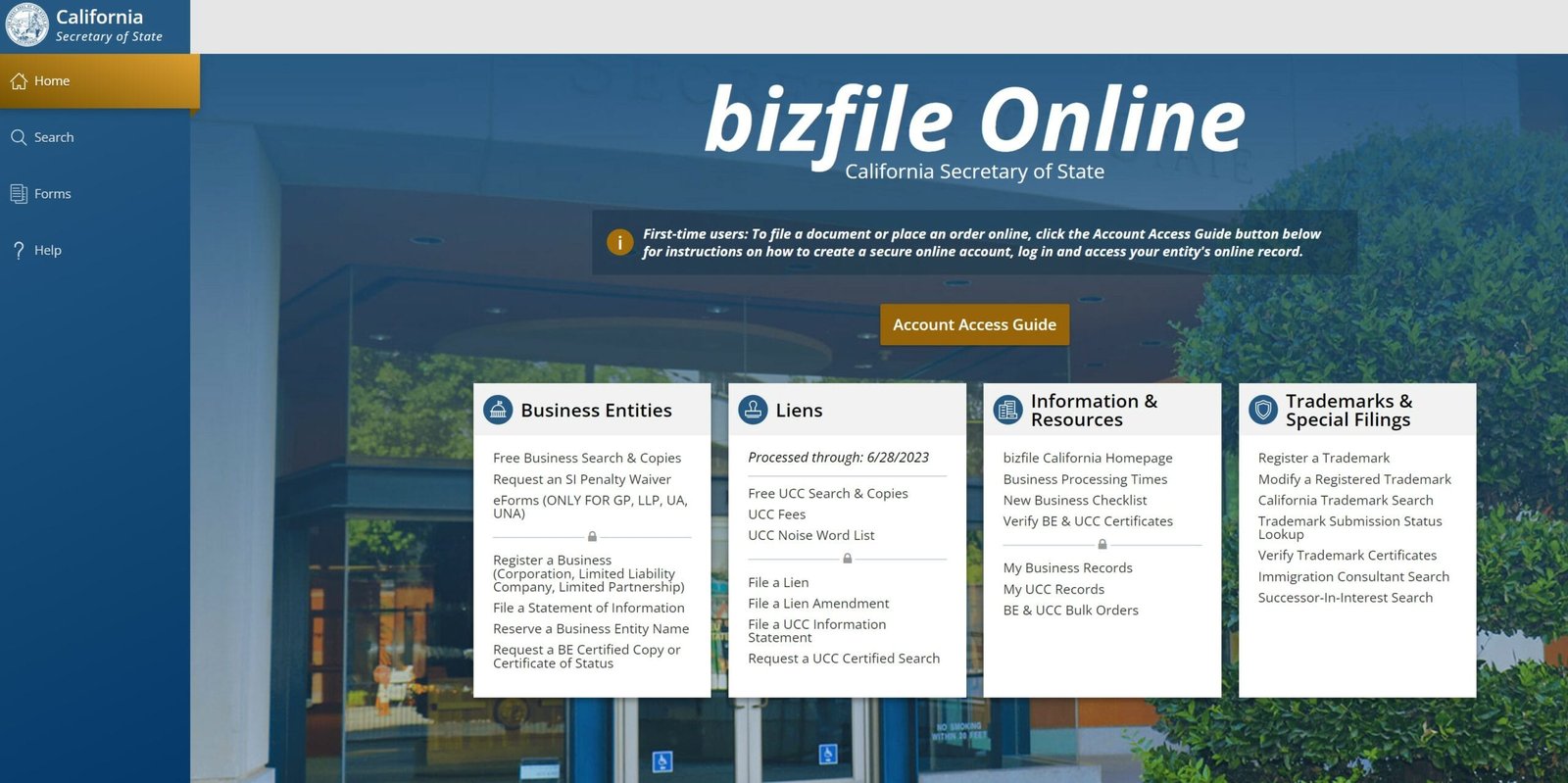

The process of filing for a California LLC online through the California Secretary of State’s website:

1. Choose a name for your LLC that complies with California’s naming requirements.

– The name must include “Limited Liability Company,” “LLC,” or “L.L.C.”

– The name must be distinguishable from the names of other businesses on file with the California Secretary of State.

2. Conduct a name availability search on the California Secretary of State’s Bizfile Online website.

– This will ensure that your desired LLC name is available and not already in use.

– If the name is available, you can reserve it for up to 60 days by filing a Name Reservation Request.

3. Determine who will be the registered agent for your LLC.

– A registered agent is a person or business entity that accepts legal documents on behalf of your LLC.

– You must have a registered agent before filing your LLC formation documents.

4. File Articles of Organization with the California Secretary of State’s website.

– The Articles of Organization document can be filed online through the California Secretary of State’s website.

– The filing fee for the Articles of Organization is $70.

5. Obtain an Employer Identification Number (EIN) from the IRS.

– An EIN is a federal tax identification number that is required for LLCs with employees or multiple members.

– You can apply for an EIN online through the IRS website.

6. Create an operating agreement for your LLC.

– Although not required by California law, it is recommended that you create an operating agreement to outline the ownership structure, management, and financial and operational policies of the LLC.

7. Register for state taxes and obtain necessary permits and licenses.

– Depending on your LLC’s business activities, you may need to register for state taxes, such as sales tax or use tax, and obtain necessary permits and licenses.

– You can register for state taxes and find information on necessary permits and licenses on the California Department of Tax and Fee Administration’s website.

In summary, to file for a California LLC online with the California state government website, you need to reserve a name, file Articles of Organization, obtain an EIN, create an operating agreement, register for state taxes, and obtain necessary permits and licenses.

Filing by Mail

A step-by-step guide on how to file for a California LLC by mail:

I. Complete the Articles of Organization

– Obtain a copy of the Articles of Organization from the California Secretary of State’s website.

– Fill out the form completely and accurately, including the LLC’s name and address, the name and address of the registered agent, and the name and address of the LLC’s organizer.

– The filing fee for the Articles of Organization is $70.

II. Prepare the Cover Letter

– Prepare a cover letter to accompany the Articles of Organization.

– The cover letter should include your name, address, and phone number, as well as the LLC’s name and a brief description of its business activities.

– You should also include a check or money order for the filing fee.

III. Mail the Documents

– Mail the completed Articles of Organization and cover letter, along with the filing fee, to the following address:

Secretary of State

Business Entities Filings Unit

P.O. Box 944228

Sacramento, CA 94244-2280

IV. Wait for Confirmation

– The California Secretary of State’s office will review your filing and notify you of the LLC’s formation by mail or email.

– This process typically takes several weeks, but expedited processing is available for an additional fee.

Overall, filing for a California LLC by mail involves completing the Articles of Organization, preparing a cover letter, mailing the documents and the filing fee to the California Secretary of State’s Business Entities Filings Unit, and waiting for confirmation of the LLC’s formation.

That’s it! With these steps, you should be able to start an LLC in California either by mail or online. It’s always recommended to consult with an attorney or accountant to ensure you’re following all the necessary steps for your specific business.

Timeframe Involved in Getting a California LLC

Here is a breakdown of the steps involved in getting an LLC in California and an estimate of how long each step takes.

Step 1: Choose a Name for Your LLC

The first step in forming an LLC in California is choosing a name for your business. You will need to make sure the name you choose is available and not already in use by another business in the state. You can search the California Secretary of State’s online database to see if the name you want is available.

Timeframe: This step can be done relatively quickly, usually within a day or two.

Step 2: File Articles of Organization

Once you have chosen a name for your LLC, you will need to file Articles of Organization with the California Secretary of State. This document establishes your LLC and includes basic information such as the name of the LLC, the registered agent, and the members of the LLC.

Timeframe: Filing the Articles of Organization typically takes around one to two weeks. However, if you choose to file online, you may receive confirmation of your LLC’s approval within a few days.

Step 3: Obtain an EIN

An EIN, or Employer Identification Number, is a unique nine-digit number that identifies your LLC for tax purposes. You will need to obtain an EIN from the IRS, even if you do not plan to hire employees.

Timeframe: Obtaining an EIN can usually be done quickly online, and you will receive your number immediately.

Step 4: Apply for Business Licenses and Permits

Depending on the type of business you plan to operate, you may need to apply for additional licenses and permits from the state or local government. This can include things like a business license, sales tax permit, or professional license.

Timeframe: The time it takes to obtain business licenses and permits can vary widely depending on the type of license or permit you need. Some licenses and permits can be obtained quickly, while others may take several weeks or even months to process.

Step 5: Create an Operating Agreement

Although it is not required by California law, it is recommended that you create an Operating Agreement for your LLC. This document outlines the management structure of your LLC and the rights and responsibilities of the members.

Timeframe: Creating an Operating Agreement can take several days or even weeks, depending on the complexity of your LLC’s management structure and the number of members.

Overall, the timeline for getting an LLC in California can range from a few days to several weeks, depending on the complexity of your business and the number of licenses and permits you need to obtain.

If you are in a hurry to get your LLC up and running, you may want to consider using an online formation service, which can expedite the process significantly.

However, if you have a more complex business structure or need to apply for multiple licenses and permits, it may take longer to complete the process.

Should I Hire an LLC Filing Service in California?

Whether or not to hire an LLC filing service in California depends on your specific needs and circumstances.

An LLC filing service can be helpful if you’re unfamiliar with the formation process, need assistance with paperwork and filing, or simply want to save time and hassle. LLC filing services can take care of the paperwork and filing process for you, so you can focus on running your business. Additionally, some LLC filing services may offer additional services, such as registered agent services or tax advice.

However, if you’re comfortable with the formation process and have the time and resources to handle the paperwork and filing yourself, hiring an LLC filing service may not be necessary.

You can file the Articles of Organization yourself by mail or online, and the process is generally straightforward. Additionally, hiring an attorney or accountant to review your documents and provide guidance can be a more cost-effective option than hiring an LLC filing service.

Ultimately, the decision to hire an LLC filing service in California is a personal one and depends on your specific needs and circumstances. It’s always recommended to do your research, compare costs and services, and consult with professionals before making a decision.

Conclusion

In summary, while the process of obtaining an LLC in California can take a bit of time, it is a relatively straightforward process that can be completed with a little bit of effort and attention to detail.

By following the steps outlined above, you can get your LLC up and running and start pursuing your entrepreneurial dreams in no time.