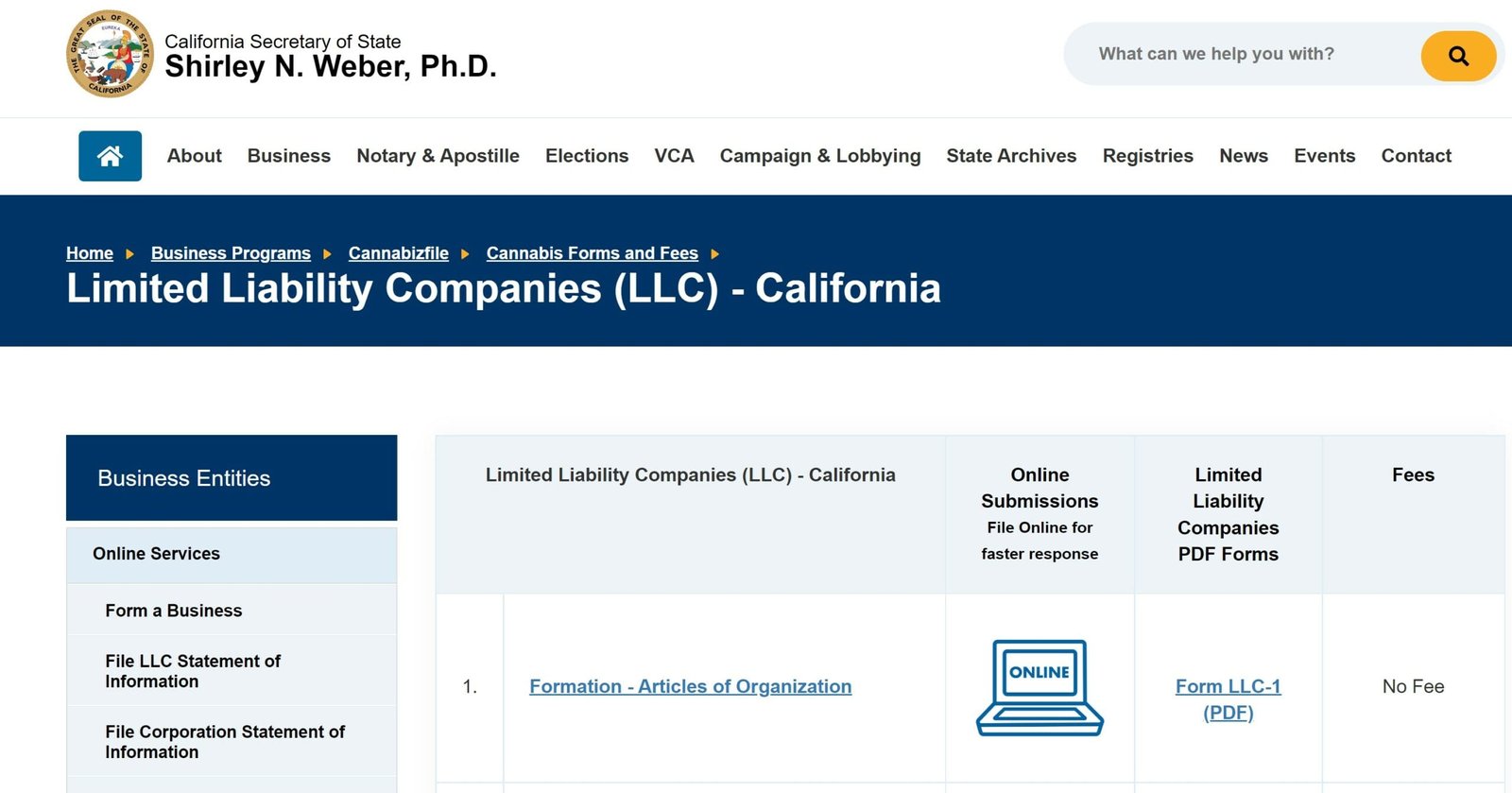

Currently, in 2023, the cost to form an LLC (limited liability company) online in California is $0. In the past, when filing the LLC’s Articles of Organization, the fee was $70. and needed to be paid to the California Secretary of State.

As of this writing, in 2023, the $800. California Franchise Fee is currently being waived for the first year.

Visit California’s new “bizfile Online” website for more information,

https://bizfileonline.sos.ca.gov/

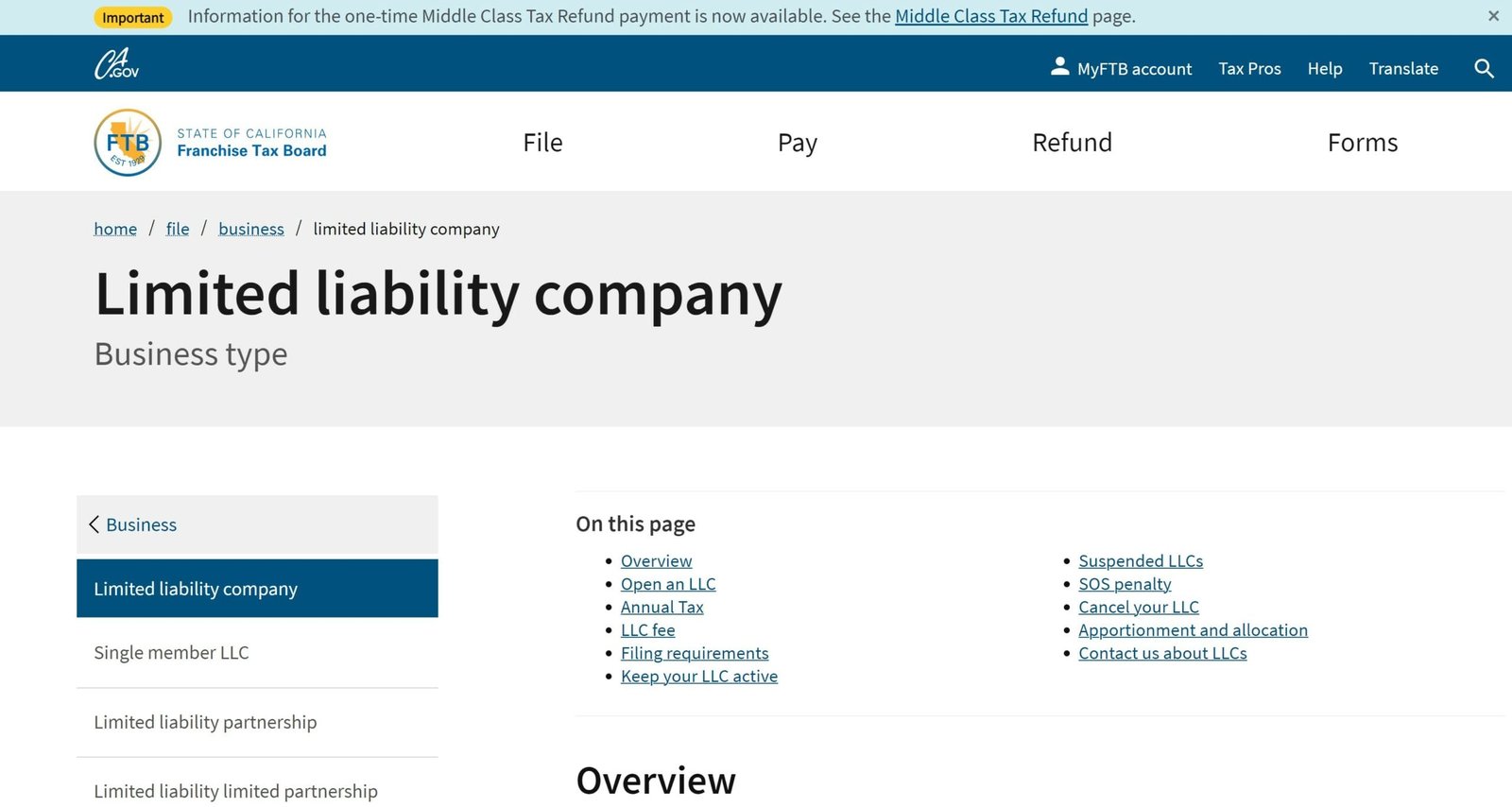

California Franchise Tax Board

https://www.ftb.ca.gov/file/business/types/limited-liability-company/index.html

Paying your annual tax

- Online

- Bank account (Web Pay)

- Credit card

- Franchise Tax Board

PO Box 942857

Sacramento CA 94257-0631Use FTB 3522 when paying by mail.

Exceptions to the first year annual tax

For tax years beginning on or after January 1, 2021, and before January 1, 2024, LLCs that organize, register, or file with the Secretary of State to do business in California are not subject to the annual tax of $800 for their first tax year.

California LLC and Corporate Taxes & Fees

Many people are concerned about the LLC fee or corporate tax when setting up a California business.

California’s corporate tax rate is 8.84 percent. This corporate tax rate is comparable with that in many other states that are popular for incorporation.

You can also use exemptions and other deductions to lower your corporate tax rate. Entrepreneurs can also benefit from the many benefits associated with different types corporations.

California Fees for Incorporation

California has a variety of fees that are associated with incorporation. Entrepreneurs will have to pay a fee in order to reserve a name. The fee must be paid to the county or city where the entrepreneur is informing. The fees will differ from one city to the next and from one county to another.

California’s Articles of Incorporation fee is $100. A handling fee of $15 is required. (As of this writing, there is “no fee” for California’s Articles of Formation.)

An initial report is required, which includes information about your business. An initial report costs $25 and a $75 service fee. California requires that all corporation owners file an annual report every year. The annual report filing fee is $25

A majority of corporations must also pay an annual tax. The California Franchise tax Board receives the minimum annual tax of $800.

You will need to pay fees if you want business licenses to your company. In most cities and jurisdictions, a small business license costs between $50 and $100. The cost of a license varies depending on the industry and type of business.

California LLC Fees & Taxes

The Statement Of Information fee must also be paid by entrepreneurs. LLC owners must submit this document within three month of forming their LLC. The Statement of Information costs $20 to file.

Business license fees are also required for LLC owners. The fees are determined by the jurisdiction or city where the company was founded.

Licenses for small businesses can cost as high as $100. It may also be necessary to obtain business licenses that are specific to your business.

You will be required to pay ongoing fees if you have an LLC. California’s LLC fees schedule includes an annual fee. The annual fee is $800, and due each April 15. This annual fee must be paid by the owners of an LLC formed within 3.5 months .

A single-member California LLC will be treated as a sole proprietorship for tax purposes. A multiple-member LLC, on the other hand is treated as a partnership.

California’s LLC tax fee is calculated based on the LLC’s total income. These income can be from any source in the world. LLCs are not subject to direct taxation by the IRS. The income from an LLC is reported on the individual tax returns for the members.

You may be required to pay an additional fee if your LLC’s annual net income exceeds $250,000.

Your LLC must register for the payroll taxes if it plans to hire employees.

- Insurance for the disabled

- California Employee Withholding Tax

- Unemployment Insurance Tax

Franchise Tax

California’s annual franchise tax is exactly as it sounds: a tax that state business owners must pay each year. If you register your California business, it is just one of the costs. Franchise tax is a unique business tax that must be paid in California and in about 12 other states.

Your business will be subject to the California annual franchising tax if it is one of the limited liability types, including limited liability company (LLC), C corporation, S corporation, C corp, limited partnerships (LP) or limited liability partnership(LLP). This tax is not applicable to sole proprietorships, general partnerships and tax-exempt nonprofits.

How to pay the California Franchise Tax

The yearly California franchise tax for non-corporate entities is $800 at the time of publication. The minimum franchise tax for corporations is $800. The minimum franchise tax due by the state is $800. For corporations, it’s either the corporation’s net income multiplied with its applicable corporate rate. The tax can be paid online, by mail or in person at the California Franchise Tax Board Branch Offices.

The type of business entity is a factor in the due date for the annual franchise taxes.

The minimum franchise tax for corporations is due in the first quarter of every accounting period.

The first-year annual franchise taxes for LLCs are due on the 15th of the fourth lunar month following the date that you file the business with Secretary of State.

The annual tax is due in subsequent years on the 15th of the fourth month of the taxable year. This is usually April 15. LLPs and LPs have slightly different deadlines. Payments are due on the 15th of the third month of your taxable year.

California Franchise Tax Exemptions

In their first year, newly incorporated corporations do not have to pay the minimum franchise taxes. Businesses are exempt from the minimum tax if they have been in business for less than 15 days and their tax year is not longer than 15 days. LLCs also qualify for the 15-day exemption from the franchise tax.

However, the franchise tax must be paid regardless of whether the entity is active or inactive, whether it files a return for less than 12 months, or whether the company is operating at loss. This rule applies to all business entities that are subject to the franchise tax. It is very difficult to escape this business expense.

The above information gives a broad overview of California’s franchise tax. However, the California Franchise Tax Board is your best source for detailed information. This entity levy and collects the tax. This site has the most current information about your business’s owes, the minimum franchise tax amount, deadlines, filing requirements, and any exemptions your business may be eligible for.

California Business Tips

If you’re looking to form an LLC in California, it’s crucial to understand the necessary steps and requirements. To begin, conduct a California LLC name search to ensure the availability of your desired business name.

Once you’ve confirmed its availability, you can proceed with preparing the essential formation documents, including registering your business name and drafting a California LLC operating agreement, which outlines the internal structure and management of your LLC.

Additionally, you have the option to be your own registered agent in California or enlist the services of a professional registered agent. It’s worth noting that the length of time to get an LLC in California can vary, but typically ranges from a few weeks to several months.

To streamline the process, it’s advisable to gather all required information and submit your filings promptly. Furthermore, obtaining a California Employer Identification Number (EIN) from the IRS is essential for tax purposes.

Detailed guides and online resources are available to help you navigate the steps involved, and various California LLC services and registered agents can assist you in forming your LLC efficiently. Additionally, ensure compliance with any necessary business licenses in California, and consider the California LLC cost while budgeting for the formation process.

Lastly, should the need arise, understanding how to change your California registered agent the steps to dissolve an LLC in California is crucial for closing your business properly.

FAQs

- What are the initial costs associated with forming an LLC in California? The primary cost when forming an LLC in California is the state filing fee for the Articles of Organization. This fee is set by the California Secretary of State and can vary, so it’s advisable to check their website for the most current rates.

- Is there an annual fee for maintaining an LLC in California? Yes, LLCs in California are required to pay an annual franchise tax to the California Franchise Tax Board. The minimum amount is set by the state and is subject to change, so it’s important to stay updated with the latest information from the Franchise Tax Board.

- Does California require any additional filings with fees for an LLC? Apart from the initial and annual fees, California LLCs must file a Statement of Information within 90 days of the Articles of Organization filing and then every two years thereafter. This filing also requires a fee, details of which can be found on the California Secretary of State’s website.

- What are the costs for a Registered Agent service in California? If you decide to use a Registered Agent service in California, the cost can vary depending on the provider. These services typically charge an annual fee and offer to handle legal document deliveries on behalf of your LLC.

- Are there any hidden fees or additional costs I should be aware of in California? While there are no hidden fees per se, there could be additional costs depending on the nature of your LLC, such as specialized permits or licenses, or fees for professional services like legal or accounting assistance.

- Can I reserve an LLC name in California, and what is the cost? Yes, you can reserve a business name for your LLC in California for a specific period before forming your LLC. This requires a Name Reservation Request Form and a reservation fee, which is set by the California Secretary of State.

- What does it cost to amend LLC documents in California? If you need to amend your LLC’s Articles of Organization, California charges a filing fee for processing amendments. The exact fee can be confirmed on the California Secretary of State’s website.

- Is there a fee for dissolving an LLC in California? Filing a Certificate of Dissolution to officially dissolve an LLC in California may involve a filing fee. You should check the latest guidelines and fees on the Secretary of State’s website.

- What penalties exist for late filings or non-compliance in California? Failing to meet filing deadlines, such as for the annual franchise tax or the Statement of Information, can result in penalties and interest charges. It’s critical to adhere to all filing timelines to avoid these additional costs.

- How can I minimize the costs of running my LLC in California? To minimize costs, consider handling some tasks yourself, like acting as your own Registered Agent if you have a physical presence in California. However, always balance the potential savings against the effectiveness and compliance risks of professional services.