How to Do a Georgia Business Name Search

Selecting the right name is an essential first step for your Georgia LLC, requiring you to ensure the name’s availability. Searching the Georgia business entity database is vital to avoid infringing on existing business names and intellectual property rights within the state.

Our Georgia LLC name search guide offers essential tips on checking LLC name availability, reservation, and registration, helping you secure a unique and compliant business identity efficiently.

How Do I Look Up an LLC in Georgia? (Summary)

Check Georgia LLC Name Search Availability

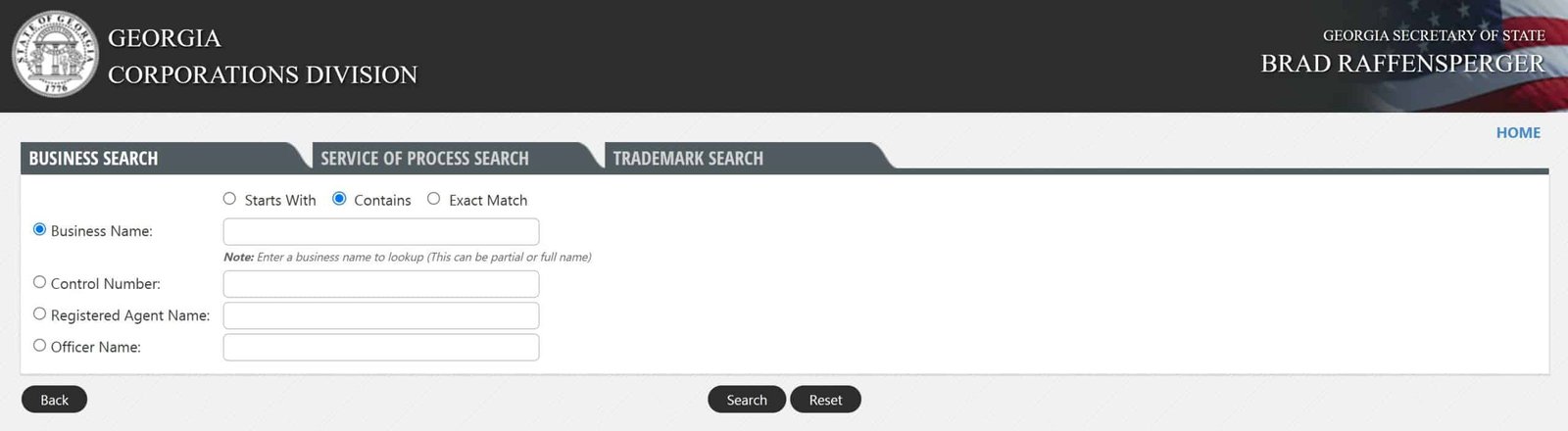

You can use the online database provided by the Georgia Secretary of State’s office. Here are the steps:

- Go to the Georgia Business Entity Database Search tool

- Search the Georgia Business Name Search tool online to check if your chosen business name is available.

- Click on the “Search for a Business” button in the top right corner.

- Select “Search by Name” or “Search by Control Number” and enter the LLC’s name or control number.

- Click on the “Search” button.

- The search results will show a list of all the LLCs that match your search criteria. Click on the LLC name to view its details, including its status, registered agent, and address.

You can also contact the Georgia Secretary of State’s office directly if you need assistance with your search.

What is a Georgia Business Entity?

A Georgia business entity refers to a business that is legally formed, recognized, and registered to operate within the state of Georgia.

The process and regulations for setting up and running a business entity in Georgia are managed by the Georgia Secretary of State’s office.

There are various types of business entities that can be established in Georgia, including:

- Sole Proprietorship: This is a business operated by a single individual who owns all the business’s assets and profits but is also personally responsible for all its debts and liabilities. There’s no legal distinction between the owner and the business.

- Partnership: This can be a general partnership, limited partnership, or limited liability partnership. It’s a business owned by two or more individuals who agree to share in the profits and losses of the business. The specific characteristics and legal implications of each type of partnership can vary.

- Corporation: A corporation is a legal entity separate from its owners (shareholders). Corporations can be for-profit (C corporations or S corporations) or not-for-profit. They have certain legal rights and responsibilities, like the ability to enter contracts, sue or be sued, and pay taxes separately from their owners.

- Limited Liability Company (LLC): An LLC is a hybrid type of business entity that combines the limited personal liability feature of a corporation with the tax efficiencies and operational flexibility of a partnership.

Georgia Secretary of State Entity Name Search

Each of these types of business entities has different requirements for formation, operation, taxation, and liability.

The process of creating a business entity in Georgia generally involves filing the necessary paperwork with the Georgia Secretary of State, paying a filing fee, and meeting other state and local business license and tax registration requirements.

Search Business Names in Georgia (Georgia LLC Lookup Guide)

Business Name Search in Georgia: A business search is a useful tool for those looking to confirm the availability of a name they are interested in before filing with the Secretary of State. A name reservation is another online option that may be useful for anyone looking to protect their future names. This guide will show you how to do it.

GA Secretary of State Business Search

Georgia Business Name Search Link

https://ecorp.sos.ga.gov/BusinessSearch

Georgia Secretary of State

The sos.ga.gov database

You can view all details about each business online, including its filing history, name history, address, and registered agent. Georgia Corporations Division did a great job creating an easy platform for these searches. Business entity name searches can be done for the following types of businesses:

- Corporation

- Limited Liability Company (LLC).

- Limited Partnership (LP).

- Limited Liability Partnership (LLP).

- Limited Liability Limited Partnership (LLLP).

Georgia Business Entity Search by Name

Step 1: The most obvious way to find a business or entity in your area is to look at its name. However, it may not be the most precise. Follow this link to the Georgia Corporations Division’s Business Search page. Enter the business name into the appropriate field.

Step 2: You will now be presented with a list of all companies whose names match the search criteria. You can view each company’s control number, business type, and address. Click on the name to see more information.

Step 3: This final page contains links to the name history, as well as the filing histories, state of formation, and date of formation.

Georgia Control Number Search

Step 1: This is a more detailed search that will require you to enter the control number for a specific business in order for the information to be displayed. To continue, simply fill in the Control number field with the correct number.

Step 2: You should only see one search result per number. Clicking on the business name will bring up additional information, such as its filing history and name history.

How to search Georgia Business Names by Registered Agent/Officer name

Step 1: If you know the registered agent’s name for a particular business or the name and title of an officer, you can use either of these pieces of information to search for the business’s details. To view the search results, enter the complete or partial name of the agent/officer in the fields.

Step 2: You will now see a list of companies for you to choose from. You will find the name of your registered agent in the second column to the left. The name of the officer can only be accessed by clicking on a company. This will give you the details of every business that you are interested in researching.

Georgia Secretary of State (Contact)

Mailing Address

2 MLK Jr. Dr. S.E.

Floyd W. Tower

Suite 814

Atlanta, GA 30344

Physical Address

214 State Capitol

Atlanta, GA 30334

Hours: Monday-Friday, 8:00 a.m.-5:30 p.m.

Email: soscontact@sos.ga.gov

Phone: (404) 656-2817

Georgia Business Tips

Forming an LLC in Georgia involves several key steps and considerations. To begin, you must complete the necessary paperwork and filings to form an LLC in Georgia.

Conducting a thorough Georgia LLC name search is crucial to ensure that your desired business name is available and meets the state’s requirements. Additionally, drafting a Georgia LLC operating agreement is essential as it outlines the internal management structure and operational guidelines for your LLC.

While you have the option to be your own registered agent in Georgia, many entrepreneurs opt to enlist the services of professional registered agents for their expertise and convenience. The length of time it takes to get an LLC in Georgia can vary depending on various factors such as processing times and the complexity of your application.

Alongside the formation process, you’ll need to obtain a Georgia Employer Identification Number (EIN) from the IRS, which is necessary for tax purposes. To streamline the process and ensure compliance, it is advisable to seek the assistance of the best LLC services in Georgia and the best registered agents in Georgia, who can guide you through the process and handle the necessary documentation.

Moreover, it’s essential to consider any required business licenses in Georgia specific to your industry and location. Understanding the associated costs to form an LLC in Georgia is crucial, as it includes filing fees and potentially additional expenses based on the services you require.

Lastly, if you ever need to change your Georgia registered agent or dissolve an LLC in Georgia, it’s important to follow the state’s dissolution procedures to conclude your business operations effectively.

Additional Steps to Consider

1. Trademark Search

When searching for a business name, it’s important to note that availability doesn’t necessarily mean the name is free to use if it’s already a registered trademark.

To avoid potential complications down the line, it’s wise to conduct a thorough trademark search using the Trademark Electronic Search System before finalizing a business name.

2. Choose a Registered Agent

After you have chosen an LLC name that is distinctive and unique, you can now choose your LLC’s Registered Agent.

3. Check if the Domain Name is Available

To check if a domain name is available, you can follow these steps:

- Go to a domain registrar website, such as GoDaddy.com or Namecheap.com.

- In the search bar on the homepage, type in the domain name you want to check.

- Click on the search button to see if the domain name is available or not.

- If the domain name is available, you will be prompted to purchase it. If it’s not available, the registrar will suggest some alternative options or you can try a different domain name.

4. Check if Social Media Name is Available

Check if a social media name is available for a new business name

5. Register Georgia Business Entity

When you complete the required documents for filing a new business entity, you then register your business and business name with the state. The state of Georgia will either approve your business name or reject it.

If you hire a good LLC service like Northwest Registered Agent, ZenBusiness or Incfile, these LLC services have business name tools available for you to do a quick search.

6. Register an Employer ID Number (EIN) With the IRS

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses and other entities for tax purposes.

7. Create a Brand Logo

Creating a business logo involves several steps. There are affordable online services that can design a logo for you and assist with the process.

Define your brand: Before you start creating a logo, you need to define your brand’s personality, values, and mission. This will help you create a logo that accurately represents your brand.

8. Write a Business Plan

Writing a business plan involves a comprehensive process that covers various aspects of your business, including the industry, market research, marketing and sales strategies, financial projections, and more.

9. Open a Business Bank Account in Georgia

A bank account is generally required for a new Limited Liability Company (LLC) or corporation to separate personal finances from business finances and to establish a clear record of business transactions.

Georgia LLC Name Search FAQs

- What is the purpose of searching for a business entity name in Georgia? Conducting a business entity name search in Georgia is essential to ensure that your desired business name is not already in use or too similar to existing names. This process helps avoid legal complications and ensures your business name is unique and identifiable.

- How can I search for a business entity name in Georgia? You can perform a business entity name search using the Georgia Corporations Division’s online search tool. This tool allows you to check the availability of your proposed business name against the database of registered business names in Georgia.

- Is there a fee for conducting a business name search in Georgia? No, performing a basic search for business name availability on the Georgia Corporations Division’s website is typically free. However, obtaining official documents or detailed reports may incur fees.

- What should I do if my preferred business name is already taken in Georgia? If your preferred business name is unavailable, you will need to choose a different name that is distinct and adheres to Georgia’s naming guidelines. It’s beneficial to have a list of alternative names prepared.

- Can I reserve a business name in Georgia before forming my entity? Yes, Georgia allows you to reserve a business name for a specified period by submitting a name reservation request along with a fee to the Corporations Division.

- What are the guidelines for naming a business entity in Georgia? In Georgia, your business name must be distinguishable from other existing business names. It should also include appropriate business type indicators such as ‘LLC’ for limited liability companies. The state provides detailed naming guidelines on the Corporations Division’s website.

- How do I ensure my chosen business name complies with Georgia’s regulations? To ensure compliance, review the naming rules provided by the Georgia Corporations Division. Additionally, conducting a trademark search can help you avoid legal issues related to name infringement.

- After finding an available name in Georgia, what are the next steps? Once you find an available business name, you can proceed to register your business entity with the Georgia Corporations Division by filing the necessary formation documents and paying any associated fees.

- Is it possible to operate under a different name than my registered business name in Georgia? Yes, in Georgia, you can operate under a ‘Doing Business As’ (DBA) name. However, ensure that the DBA name is also registered and does not conflict with other registered business names.

- How often is the Georgia business name database updated? The Georgia business name database is updated regularly to reflect new business registrations and changes. For the most accurate and current information, perform your search close to your business registration time.