Contents

ToggleHow to Do a Florida Business Name Search

Selecting the right name is an essential first step for your Florida LLC, requiring you to ensure the name’s availability. Searching the Florida business name database is vital to avoid infringing on existing business names and intellectual property rights within the state.

Our Florida LLC name search guide offers essential tips on checking LLC name availability, reservation, and registration, helping you secure a unique and compliant business identity efficiently.

How Do I Look Up an LLC in Florida? (Summary)

To Look Up Florida LLC Name Search Availability, you can follow these steps:

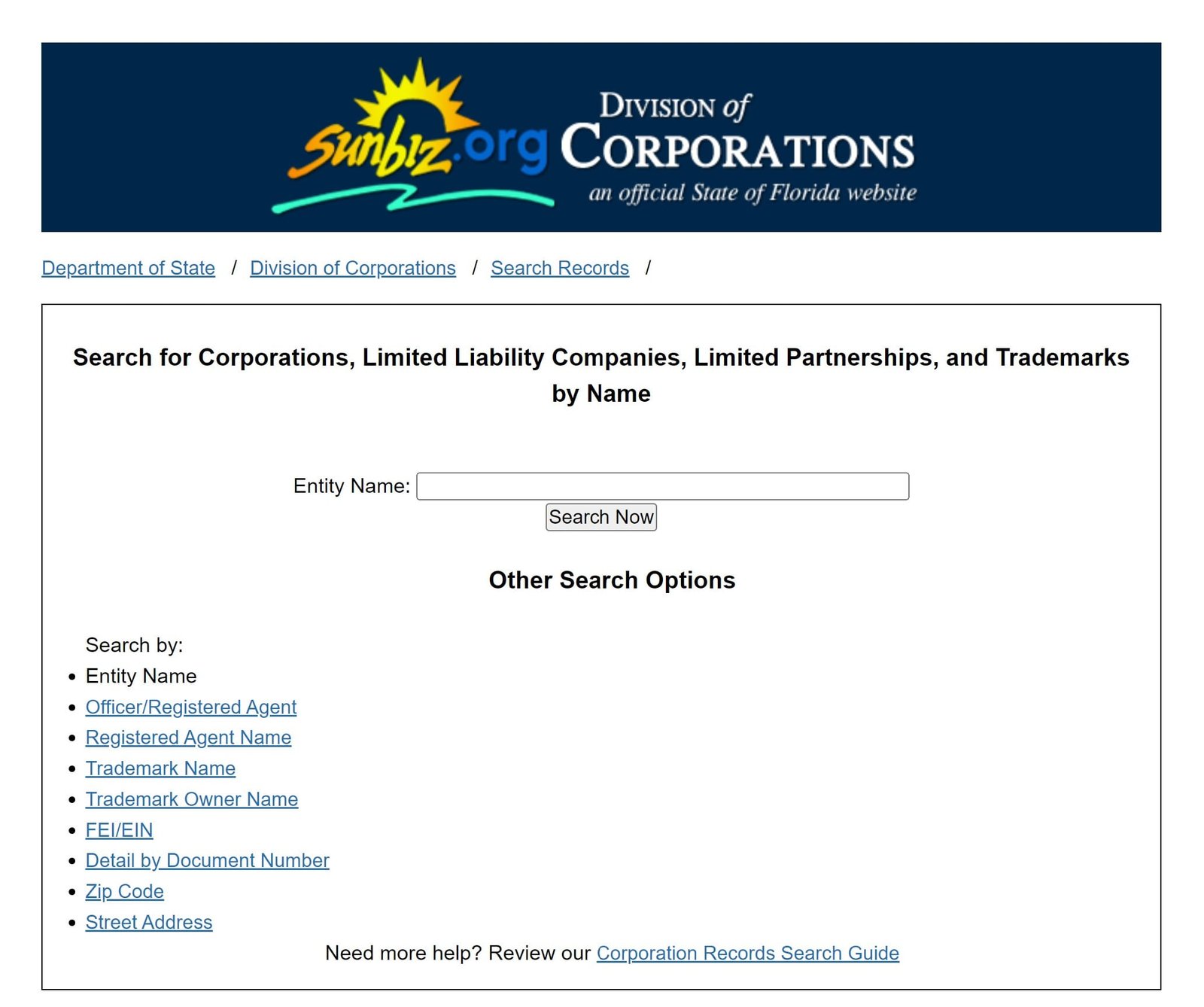

- Go to the Florida Business Entity Database Search

Search the Florida Sunbiz Direct Name Search to check if your chosen business name is available.

Click on the “Search Records” tab.

Under the “Entity Name” section, enter the name of the LLC you want to look up.

You can also search by “Registered Agent Name” or “Document Number” if you have that information.

Click on the “Search” button.

A list of results will appear. Locate the LLC you are looking for and click on the name to view more details.

You will be able to see the LLC’s status, registered agent, principal office address, and other details.

If you cannot find the LLC you are looking for, it is possible that it is not registered with the state of Florida.

What is a Florida Business Entity?

A Florida business entity is an organization that is legally recognized and registered to operate within the state of Florida.

The process and regulations for setting up and running a business entity in Florida are managed by the Florida Division of Corporations, also known as the Florida Department of State.

There are various types of business entities that can be established in Florida, similar to other states, including:

Sole Proprietorship: This is a business run by an individual. The business and the owner are considered the same entity from a legal perspective. The owner has personal liability for the business.

Partnership: This can be a general partnership, limited partnership, or limited liability partnership. It’s formed by two or more individuals who agree to share in the profits and losses of a business.

Corporation: This is a separate legal entity owned by shareholders. A corporation can be either a for-profit (C corporation or S corporation) or a nonprofit organization.

Limited Liability Company (LLC): This is a hybrid business entity offering the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership.

Florida Department of State Entity Search

Each of these entities has its own rules regarding formation, operation, taxation, and liability. When establishing a business entity in Florida, you typically need to file the appropriate documents with the Florida Department of State, and possibly pay a filing fee, depending on the type of entity.

Florida Business Name Search: Before you file your paperwork, you must conduct a thorough search to verify the availability of LLC names in Florida. This can be done at the Florida Division of Corporations website.

Florida LLC Lookup (Name Search Guide)

The first step in forming an LLC in Florida is to choose your name. The name of your LLC must be unique and meet certain criteria.

You can search the Florida Division of Corporations website using:

- The name of the entity

- The name of the officer

- The registered agent is named

- The name of the partner

- The FEI/EIN is the federal employer identification number.

- The document number

You can complete this search for free.

Florida Entity Name Database Search

For a start, go to the page “Entity Name Search”.

Enter your desired name in the search box. Don’t worry about capitalization. Make sure to include at least the first few words of your name in the search box.

This will allow you to search for all names similar to yours. To make a more detailed search, you can input just part of the first letter.

If you want to call your business Printing for You, then simply type “print” in its place.

Click “Search Now” to view all Florida-based businesses. This will allow you to determine if your desired name is available. You can file the necessary paperwork with the state if you’re unsure.

You will be notified if your name is similar to that of another business.

This is why this step must be completed before you invest in any domains or marketing materials.

Florida Entity Name Database Search: Search by Name

You can search by potential names if you want to do so. This search is for all general partnerships and limited liability businesses, as well as all other types of entities. You can choose to enter your full name or a portion of it.

Click on similar entities to learn more. This page will allow you to view information like the EIN of your LLC and the principal address. You can also access annual reports.

You also have the option to search by officer/partner/registered agent name or by a federal employer identification number.

Florida LLC Name Requirements

When forming an LLC you must include “limited liability”, or “LLC” within the name. You can also use “L.L.C.” You cannot use the abbreviations “corporation” and “incorporated” as you are not forming a corporation. Your name must be distinct — grammar differences do not count.

Search Status for Entity Names

If you find names that are “active”, they may not be available for your use. The name might not be available even if the company’s status reads “INACT/UA”.

Sometimes, companies may be marked as inactive due to not being in good standing. They may not have filed an annual report. These names generally become available within one year.

The same applies to “inactive” businesses. The company may have been dissolved by its owners, but this does not necessarily mean that the name can be used. These two statuses may also be available:

- “NAME HS” – This indicates that a company has changed its name. Their original name may or not be available.

- “CROSSRF” – This is an example of a cross-reference name that may not be accessible for use.

Florida: Setting up a DBA

Search the Fictitious name database before you file a DBA (or “doing business under”). You can register if the name you are interested in is available. Florida offers an online registration for fictitious names.

Before you register, please ensure you are familiar with all the laws in Florida. contains all the general information.

The DBA will remain valid for five years after it is registered. You can apply for renewal after the DBA expires.

Florida Secretary of State (Contact)

Mailing Address

P.O. Box 6327

Tallahassee, FL 32314

Physical Address

The Centre of Tallahassee

2415 N. Monroe St., Ste. 810

Tallahassee, FL 32303

Hours: Monday to Friday 8:00 a.m. – 5:00 p.m. EST

Online Contact Form: sunbiz.org/contact.html

Phone: (850) 245-6000

Fax: (850) 245-6014

Florida Business Tips

Forming an LLC in Florida involves several key steps and considerations. To begin, you must complete the necessary paperwork and filings to form an LLC in Florida.

Conducting a thorough Florida LLC name search is crucial to ensure that your desired business name is available and meets the state’s requirements and get your Florida entity name registered. Additionally, drafting a Florida LLC operating agreement is essential as it outlines the internal management structure and operational guidelines for your LLC.

While you have the option to be your own registered agent in Florida, many entrepreneurs opt to enlist the services of professional registered agents for their expertise and convenience. The length of time it takes to get an LLC in Florida can vary depending on various factors such as processing times and the complexity of your application.

Alongside the formation process, you’ll need to obtain a Florida Employer Identification Number (EIN) from the IRS, which is necessary for tax purposes. To streamline the process and ensure compliance, it is advisable to seek the assistance of the top-rated LLC services in Florida and the best registered agents in Florida, who can guide you through the process and handle the necessary documentation.

Moreover, it’s essential to consider any required business licenses in Florida specific to your industry and location. Understanding the associated costs to form an LLC in Florida is crucial, as it includes filing fees and potentially additional expenses based on the services you require.

If you need information on getting a Florida resale certificate, we have that.

Lastly, if you ever need to change your Florida registered agent or dissolve an LLC in Florida, it’s important to follow the state’s dissolution procedures to conclude your business operations effectively.

Additional Steps

1. Trademark Search

When searching for a business name, it’s important to note that availability doesn’t necessarily mean the name is free to use if it’s already a registered trademark.

To avoid potential complications down the line, it’s wise to conduct a thorough trademark search using the Trademark Electronic Search System before finalizing a business name.

2. Choose a Registered Agent

After you have chosen an LLC name that is distinctive and unique, you can now choose your LLC’s Registered Agent.

3. Check if the Domain Name is Available

To check if a domain name is available, you can follow these steps:

- Go to a domain registrar website, such as GoDaddy.com or Namecheap.com.

- In the search bar on the homepage, type in the domain name you want to check.

- Click on the search button to see if the domain name is available or not.

- If the domain name is available, you will be prompted to purchase it. If it’s not available, the registrar will suggest some alternative options or you can try a different domain name.

4. Check if Social Media Name is Available

Check if a social media name is available for a new business name

5. Register Florida Business Entity

When you complete the required documents for filing a new business entity, you then register your business and business name with the state. The state of Florida will either approve your business name or reject it.

If you hire a good LLC service like Northwest Registered Agent, ZenBusiness or Incfile, these LLC services have business name tools available for you to do a quick search.

6. Register an Employer ID Number (EIN) With the IRS

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses and other entities for tax purposes.

7. Create a Brand Logo

Creating a business logo involves several steps. There are affordable online services that can design a logo for you and assist with the process.

Define your brand: Before you start creating a logo, you need to define your brand’s personality, values, and mission. This will help you create a logo that accurately represents your brand.

8. Write a Business Plan

Writing a business plan involves a comprehensive process that covers various aspects of your business, including the industry, market research, marketing and sales strategies, financial projections, and more.

9. Open a Business Bank Account in Florida

A bank account is generally required for a new Limited Liability Company (LLC) or corporation to separate personal finances from business finances and to establish a clear record of business transactions.

Florida Business Name Search FAQs

What is the purpose of searching for a business entity name in Florida? The search is essential for anyone looking to establish a new business in Florida. It ensures that the desired business name is not already in use or too similar to existing names in the state’s database. This is a crucial step to comply with Florida’s business registration laws and avoid legal issues.

How can I perform a business entity name search in Florida? You can conduct this search through the Florida Division of Corporations’ official website, using their online search tool. This tool allows you to check the availability of your desired business name by comparing it with existing names in their records.

Is there a cost associated with conducting a business name search in Florida? Typically, there is no fee for performing a preliminary business name availability search through the Florida Division of Corporations’ website. However, if you require detailed reports or certified documents, there may be associated fees.

What steps should I take if my desired business name is already taken in Florida? If your chosen name is unavailable, you’ll need to create a different name that is unique and complies with Florida’s naming guidelines. It’s beneficial to have a list of alternative names ready to streamline the process.

Can I reserve a business name in Florida before forming my entity? Yes, Florida allows the reservation of a business name. You can file a name reservation application with the Division of Corporations, which typically reserves the name for a specified duration and requires a fee.

What are Florida’s specific requirements for business entity names? Florida requires that your business name be distinguishable from other names on record. Additionally, certain business types like LLCs and corporations must include specific designators (e.g., LLC, Inc.) in their names. The name must not contain terms that could mislead about the nature of the business.

How do I ensure my chosen business name complies with Florida’s regulations? To ensure compliance, review the naming guidelines provided by the Florida Division of Corporations. It’s also advisable to conduct a trademark search and consult with a legal expert if you’re uncertain about the suitability of your chosen name.

What are the next steps after finding an available business name in Florida? Once you confirm the availability of your business name, you can proceed to register your business entity with the Florida Division of Corporations by filing the appropriate formation documents under that name.

Can I operate under a different name than my registered business name in Florida? Yes, you can operate under a ‘Doing Business As’ (DBA) name in Florida. However, you must ensure the DBA is registered and distinct from other registered names in the state.

How current is the information in the Florida business name database? The Florida Division of Corporations regularly updates its database to reflect new registrations and changes. However, for the most up-to-date information, it’s advisable to perform your search close to your planned registration date.

Business Name Search by State

Hi Brian, one suggestion I would like to offer is to provide some real-life examples or case studies to illustrate the challenges that entrepreneurs might encounter during the name search. This would further enhance the practicality of your article and help readers better understand the potential complexities involved.

Thanks David

Brian, your inclusion of potential naming restrictions and guidelines set by the state of Florida was spot-on. This information is essential for entrepreneurs to ensure compliance.

Thanks Victoria

Brian, the way you explained the significance of conducting a thorough name search was highly informative. I appreciate your attention to detail and the step-by-step instructions you provided. The mention of resources like the Florida Department of State website and other relevant databases was incredibly useful, making the search process more accessible and efficient.

Thanks Larry

Overall, Brian, your article has given me a clear understanding of how to conduct a business name search in Florida. I genuinely appreciate your efforts in creating a well-structured and informative guide. Thank you for sharing your knowledge and expertise.

Thanks Madison

Brian, I appreciated your inclusion of potential naming restrictions and guidelines set by the state of Florida. This information ensures that entrepreneurs are aware of any limitations and can make informed decisions during the name search process.

Thanks Charlotte