Contents

ToggleA Resale Certificate is a Texas document that allows businesses to buy items without having to pay sales tax. Sometimes, this certificate is called a Texas Sales and Use Tax Resale Certificate or a Sales Tax Exemption Certificate.

A Texas Comptroller of Public Accounts permit must be obtained by businesses that intend to resell items purchased with a Resale Certificate.

About to start a business in Texas? You may wish to obtain a resale certificate, or several of them before you begin conducting a business that will sell goods or services in Texas. Doing so can help you save a lot of time and money.

As shown in this step-by-step manual, the procedure is fairly straightforward.

https://comptroller.texas.gov/taxes/sales/forms/

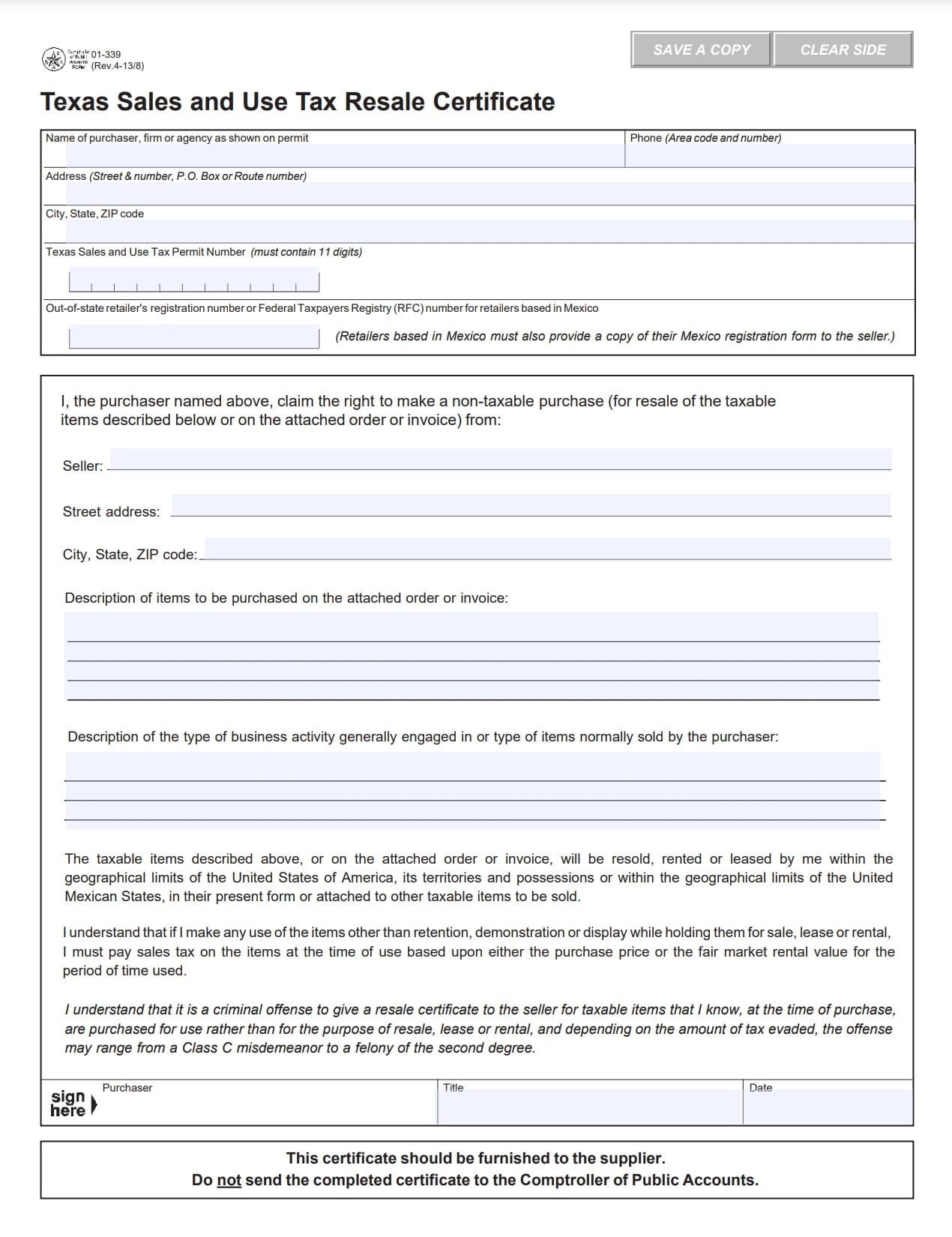

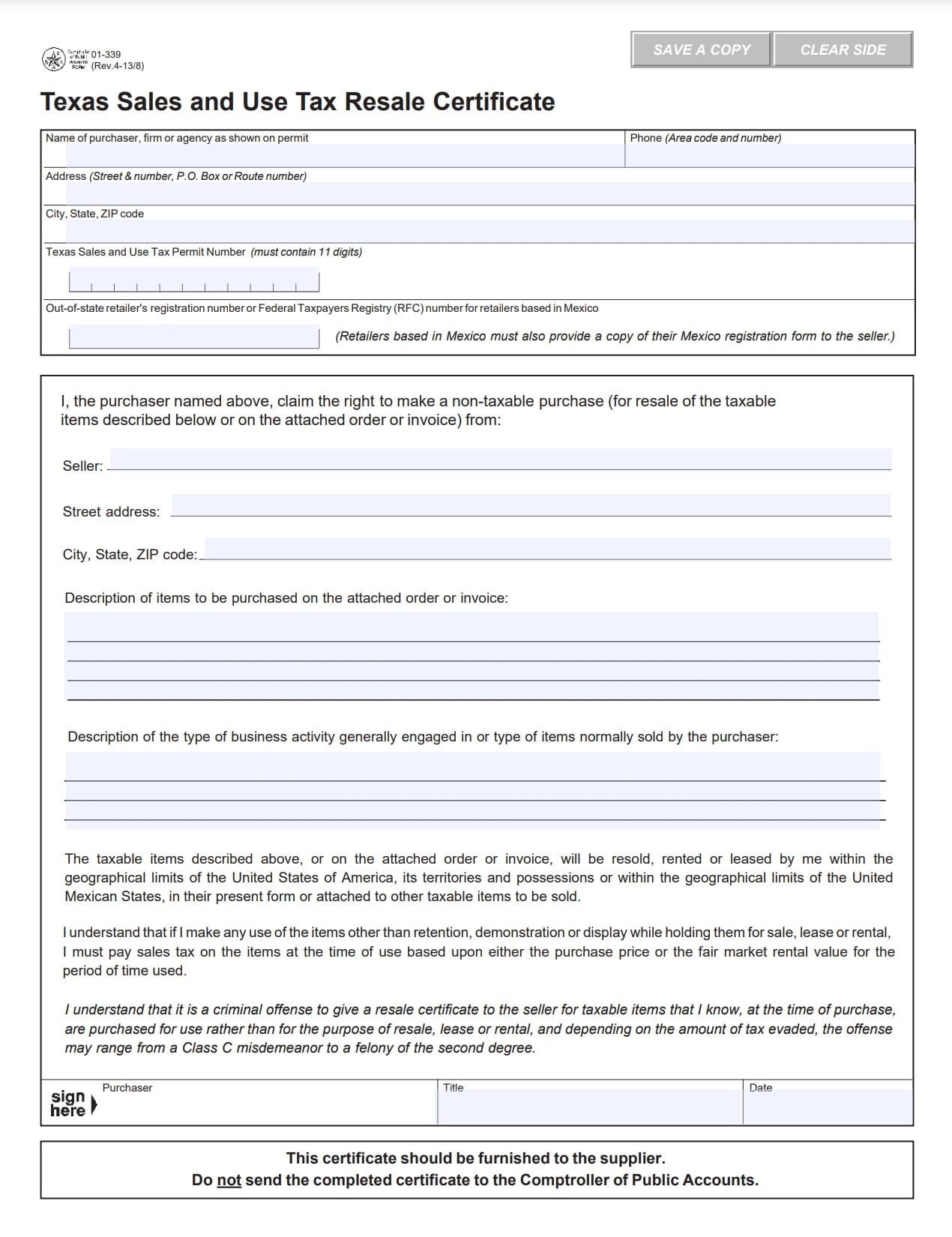

The Texas Sales and Use Tax Resale Certificate Form 01-339

Find out more about resale certificates and how to obtain one.

What is a Texas Resale Certificate and how do you use it?

Retailers often purchase products for resale and don’t have to pay sales tax. While sales tax is still payable, the retailer will charge sales tax to the customer on the merchandise’s final value. The retailer then sends the collected sales tax to the Texas Comptroller of Public Accounts.

A pet shop might purchase dog toys from a supplier to sell in their store. The pet store owner will not normally have to pay sales taxes to the supplier. The retailer will charge the customer sales tax based on the full cost of the toy when a customer (or end-user) buys the dog toy. The retailer will collect sales tax from all transactions and send it to the state periodically, usually at the end of the month.

The certificate serves to prove that no sales tax was collected on a transaction. A resale certificate can also be called a reseller number, seller’s permit, exemption certificate, or wholesale license. To allow tax-exempt purchases, the seller must prove that the buyer intends to resell the product. This can be done by providing a valid certificate.

The exemption from sales tax is for inventory that will be sold and not for tax-free purchases of normal business items such as paper, pens, and so on.

Is a Texas Sales Tax Permit Required?

Yes, a Texas Sales Tax Permit is required before a business can sell products or provide taxable services. Sometimes, the Sales Tax Permit can be called a seller’s license, sales tax number, or sales tax license.

Is a Resale Permit the same as a Sales Tax Permit or a Resale Certificate?

Although they may be mistaken for one another, the Resale Certificate and Sales Tax Permit are two distinct documents. The Resale Certificate permits a retailer to purchase tax-exempt products for resale.

The Comptroller’s Office will issue a Texas Sales and Use Tax Permit number with 11 numbers after you have registered. This number will appear on the Sales and Use Tax Resale Certificate.

How to complete the Texas Sales and Use Tax Resale Certificate Form 01-339

Although it is easy to fill out Form 01-339, it is crucial for the seller that they have all of the necessary information.

If purchases are made solely for resale, only one certificate is required. A blanket certificate should be provided to the state that all purchases are being resold as normal.

The Texas Comptroller of Public Accounts will require that the seller has a properly filled-out Form 01-339 Sales & Use Tax Resale Certificate to be audited. If the seller does not complete it correctly, they could be liable for sales taxes that should have gone to the buyer as well as penalties and interest.

Steps to fill out Form 01-339 Texas Use Tax Resale Certificate

Step 1 Download the Texas Sales and Use Tax Resale Certificate Form 01-339

Step 2: Identify the name, address, and phone number for the purchaser

Step 3: Input the Texas Sales and Usage Tax Permit Number. If the purchaser is not in Texas, enter their state’s sales tax permit #

Step 4: Include the name and street address

Step 5: Give a description of the items you wish to purchase

Step 6: Description of the business that the buyer is selling

Step 7: The purchaser will sign and date the certificate and certify that the property is being purchased for resale.

What is the cost of a Texas Resale Certificate?

A Texas resale certificate is free.

Is a Texas Resale Certificate valid for a year?

Texas Sales and Use Tax Resale Certificates don’t expire.

Do I Have to File for Texas Resale Certificate?

The seller keeps the resale certificate on file, and it is not filed with Comptroller’s Office.

Do sellers have to accept the resale certificate?

Although sellers are not required to accept certificates of resale, many do. The buyer will be responsible for any sales tax if the seller refuses to accept the certificate. In most cases, the Texas sales tax filing will provide a credit.

What steps should a business take to accept a certificate of resale?

A resale certificate is a document that a seller presents to a business. The seller is responsible for verifying the buyer’s information and keeping these records. Failure to verify the information could make the seller liable for Texas sales tax.

A seller must:

- Check the resale certificates to ensure it is complete.

- Verify that the purchaser holds a valid sales tax permit by visiting the Texas Comptroller of Public Accounts Taxpayer Search Database.

- Sellers must also examine the certificate to determine if the goods are reasonably consistent with the buyer’s business line. If the buyer owns a car dealership and wants to buy office supplies tax-free then the seller should investigate further.

- Keep four-year-old records of tax-free transactions and resale certificates in a file.

Does a Texas Resale Certificate Expire?

No, Texas resale certificates do not expire.

Texas LLC

When you’re looking to form an LLC in Texas, conducting a Texas LLC name search is crucial to ensure that your desired business name is available and compliant with the state’s requirements.

Once you’ve confirmed name availability, you can proceed with the formation process and get your Texas business name registered.

Drafting a Texas LLC operating agreement is highly recommended to establish the internal rules and regulations of your LLC. You have the option to act as your own registered agent in Texas, handling the receipt of important legal and tax documents on behalf of your LLC.

The length of time to get an LLC in Texas may vary based on several factors, including the filing method and the workload of the Texas Secretary of State. It typically takes around 2-3 weeks for the formation documents to be processed and the LLC to be officially recognized.

As part of the process, you will need to obtain an Employer Identification Number (EIN) for your TExas business from the Internal Revenue Service (IRS). This unique identifier is necessary for tax purposes, opening bank accounts, and hiring employees.

Several online platforms and registered agents offer comprehensive LLC services, including name availability searches, document preparation, and filing assistance.

Researching and selecting the best LLC services and registered agents in Texas can help streamline the formation process and ensure compliance with state regulations.

Additionally, depending on the nature of your business activities, you may need to acquire specific Texas business licenses at the state or local level.

The cost to form an LLC in Texas typically includes filing fees and any additional expenses related to name reservation, certified copies, or expedited processing. The cost is the same even for a single-member LLC in Texas.

Lastly, if you ever decide to change your registered agent or dissolve and close your LLC in Texas, there are specific legal requirements and procedures that must be followed to formally terminate the entity.

FAQs and Wrapping Up

[rank_math_rich_snippet id=”s-99381398-7d2a-48cd-befb-424c0266f9b3″]

Resale certificates can be a headache, but they are a requirement in Texas. In order to assure complete compliance with your state’s tax laws, take the time to obtain certificates for each of your vendors.