Contents

ToggleHow to Do an Indiana LLC Name Search

Selecting the right name is an essential first step for your Indiana LLC, requiring you to ensure the name’s availability.

Searching the Indiana business entity database is vital to avoid infringing on existing business names and intellectual property rights within the state.

Our Indiana LLC name search guide offers essential tips on checking LLC name availability, reservation, and registration, helping you secure a unique and compliant business identity efficiently.

Business Entity Search in Indiana: How To Look Up an LLC in Indiana? (Summary)

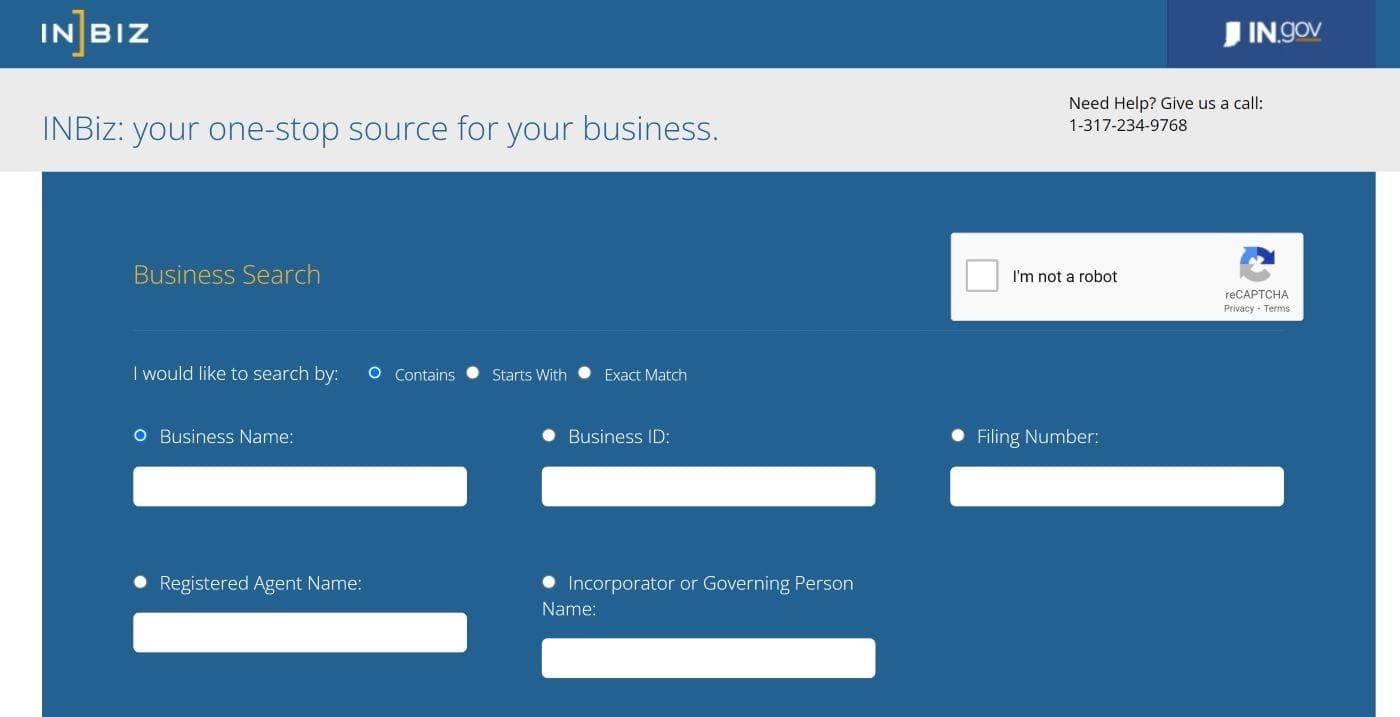

- Visit the Indiana Secretary of State’s Business Entity Database search page, Indiana INBiz Name Search to check if your chosen business name is available.

- Type in the name of the LLC you are searching for in the “Entity Name” field. If you are unsure of the name, you can also search by the registered agent’s name or the business ID number.

- Click the “Search” button.

- A list of entities matching your search criteria will appear. Locate the LLC you are searching for and click on its name.

- The LLC’s details will be displayed, including its name, business ID number, registered agent, principal office address, and status.

Note that some LLCs may be exempt from public disclosure of their information, so not all LLCs may be listed on the website.

Search Business Entity Names in Indiana

Step #1 – Check the Indiana LLC Name Requirements

There are some requirements that you must know before searching for your Indiana LLC name:

1. The abbreviations “LLC” and “L.L.C. must be added to the end of your Indiana LLC. The most commonly used abbreviation is “LLC”.

2. An Indiana LLC is not a Corporation. Your desired LLC name cannot use the words “Corporation”, “Incorporated,” and their abbreviations (“Corp.” or “Inc .”).).

3. The name of your LLC must be distinctive. It must be distinct from all other Indiana businesses.

Differentiability is not created by differences in designators (identifiers at end of business names) or in grammar.

- LLC, L.L.C, Inc., Corp.

- Single, plural, and possessive

- A, An, The

- and, or, &

- hyphens, slashes, periods, commas

- Three vs.

Indiana Business Entity Search

Step #2 – Search the Indiana Name Database

1. Visit the Indiana state database

Go to the INBiz: Department of Business Services Database

2. Choose defaults

You will find the “Business Search” section at the top of this form. Select “Starts with” or “Business Name”. They may be the defaults.

The bottom half of “Advanced Search” can be ignored. It is not necessary.

3. Find your LLC

In the “Business Name Search Box, enter your desired LLC name.

- You can leave out the “LLC” ending and punctuation.

- Capitalization doesn’t matter.

- To ensure that you are thorough, enter only the first or two words of your LLC name. This will allow you to see all information that could be similar. If your Indiana LLC name is Johnny Apple Farm LLC, enter “Johnny Apple”.

- You can only enter a portion of the first word to make it more detailed. If your Indiana LLC name is Printing Solutions LLC, enter “print”.

4. Check out the Results

To browse the Indiana business listings, click the “Search” button at the bottom.

- A “No Data Found” message will indicate that your chosen LLC name is available.

- If you see names that are similar to yours (meaning they are distinguishable), your chosen LLC name can be used.

- Your desired LLC name is unavailable if it appears in the list. It is possible to come up with unique names or creative variations.

- Your desired LLC name cannot be used if the results show a similar name. It is possible to come up with unique names or creative variations.

Tip Don’t worry if your Indiana LLC name isn’t unique. You can still file paperwork with the state. The state will notify you if your name isn’t available and send your file back.

Contact Information for the Indiana Secretary of State

You can reach the Indiana Secretary Of State at 317-234-96768 for any questions (8:00 AM to 4:30 PM, M-F).

Indiana Secretary of State (Contact)

Mailing Address

Business Services Division

302 W. Washington St.

Room E018

Indianapolis, IN 46204

Physical Address

200 W. Washington St., Room 201

Indianapolis, IN 46204

Email: INBiz@sos.in.gov

Phone: (317) 234-9768

Indiana Business Entity Tips

When you’re ready to start an LLC in Indiana, there are key steps to follow. Begin by conducting an Indiana entity name search to ensure that your desired business name is available for registration. Once confirmed, it’s important to draft an Indiana LLC operating agreement, outlining the internal workings and guidelines of your LLC.

You have the option to serve as your own registered agent in Indiana, or you can opt for professional registered agent services. The timeframe for obtaining an LLC in Indiana can vary, typically ranging from a few weeks to a couple of months.

To streamline the process, ensure all necessary information is gathered and promptly submit your filings. Obtaining an Employer Identification Number (EIN) is essential for tax purposes, and you can follow the necessary steps to obtain one from the IRS. Consider utilizing one of the top LLC services in Indiana to receive expert assistance and ensure compliance with all legal requirements throughout the formation process.

Engaging the best registered agent services in Indiana can provide efficient handling of critical documents and legal notifications. Don’t forget to acquire a business license specific to Indiana, adhering to the licensing requirements relevant to your industry and location. As you plan your LLC formation budget, factor in the cost to start an LLC in Indiana, including filing fees and any additional services you choose.

If you ever need to change your registered agent, we have an article on that.

Lastly, if the time comes to close and dissolve an Indiana LLC, understanding the proper steps and regulations is essential. Seek guidance from legal professionals to ensure a smooth dissolution process in compliance with Indiana state laws and requirements.

Additional Steps to Consider

1. Trademark Search

When searching for a business name, it’s important to note that availability doesn’t necessarily mean the name is free to use if it’s already a registered trademark.

To avoid potential complications down the line, it’s wise to conduct a thorough trademark search using the Trademark Electronic Search System before finalizing a business name.

2. Choose a Registered Agent

After you have chosen an LLC name that is distinctive and unique, you can now choose your LLC’s Registered Agent.

3. Check if the Domain Name is Available

To check if a domain name is available, you can follow these steps:

- Go to a domain registrar website, such as GoDaddy.com or Namecheap.com.

- In the search bar on the homepage, type in the domain name you want to check.

- Click on the search button to see if the domain name is available or not.

- If the domain name is available, you will be prompted to purchase it. If it’s not available, the registrar will suggest some alternative options or you can try a different domain name.

4. Check if Social Media Name is Available

Check if a social media name is available for a new business name

5. Register Indiana Business Entity

When you complete the required documents for filing a new business entity, you then register your business and business name with the state. The state of Indiana will either approve your business name or reject it.

If you hire a good LLC service like Northwest Registered Agent, ZenBusiness or Bizee, these LLC services have business name tools available for you to do a quick search.

6. Register an Employer ID Number (EIN) With the IRS

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses and other entities for tax purposes.

7. Create a Brand Logo

Creating a business logo involves several steps. There are affordable online services that can design a logo for you and assist with the process.

Define your brand: Before you start creating a logo, you need to define your brand’s personality, values, and mission. This will help you create a logo that accurately represents your brand.

8. Write a Business Plan

Writing a business plan involves a comprehensive process that covers various aspects of your business, including the industry, market research, marketing and sales strategies, financial projections, and more.

9. Open a Business Bank Account in Indiana

A bank account is generally required for a new Limited Liability Company (LLC) or corporation to separate personal finances from business finances and to establish a clear record of business transactions.

Indiana LLC Name Search FAQs

Here are three frequently asked questions and their answers related to forming an LLC in the state of Indiana:

- What are the steps to form an LLC in Indiana?

To form an LLC in Indiana, you need to follow these steps:

- Choose a name for your LLC that is unique and not already in use.

- Appoint a registered agent who will receive legal documents on behalf of your LLC.

- File Articles of Organization with the Indiana Secretary of State and pay the filing fee.

- Create an operating agreement that outlines how your LLC will be run.

- Obtain any necessary licenses and permits to operate your business in Indiana.

- Obtain an EIN (Employer Identification Number) from the IRS for tax purposes.

- How much does it cost to form an LLC in Indiana?

The filing fee for Articles of Organization in Indiana is $95. However, if you file online, the fee is reduced to $85. Additionally, if you choose to use a registered agent service, there may be additional fees.

It’s also worth noting that there may be other costs associated with forming and operating an LLC, such as obtaining licenses or hiring an attorney to help with the process.

- What are the advantages of forming an LLC in Indiana?

There are several advantages to forming an LLC in Indiana, including:

- Limited liability protection: LLC owners are generally not personally liable for the debts and obligations of the business.

- Flexible taxation: LLCs can choose to be taxed as a sole proprietorship, partnership, S corporation, or C corporation, depending on their needs.

- Simplified management structure: LLCs do not have the same formal management requirements as corporations, which can make them easier to operate.

- Professional credibility: Forming an LLC can help establish your business as a professional entity and may make it easier to obtain financing or enter into contracts with other businesses.

References

Indiana LLC Act: Section 23-18-2-8

Indiana Secretary of State: An Entrepreneur’s Guide to Starting A Business in Indiana