Contents

ToggleBest LLC Services in Idaho

Starting a Limited Liability Company (LLC) in Idaho offers a blend of asset protection, and simplicity, making it an attractive option for many entrepreneurs and business owners.

Choosing a good LLC formation service can simplify the process, ensuring that your business complies with Idaho’s rules and requirements.

In this article, I review and compare the top LLC formation companies in Idaho, highlighting their features, benefits, and how they can assist in making the LLC setup process seamless and efficient.

With the help of a reliable LLC formation service, you can focus on growing your business while leaving the paperwork to the experts.

Top LLC Companies in Idaho

- Northwest Registered Agent (Best Overall)

- Bizee

- ZenBusiness

- LegalZoom

The Best LLC Service in Idaho

We recommend Northwest Registered Agent.

Northwest is Best-In-Class: Some other LLC services maybe cheaper but those other LLC services may also sell your private data.

Northwest is a professional firm with top-quality customer support and a policy of ‘Privacy by Default’ for their clients.

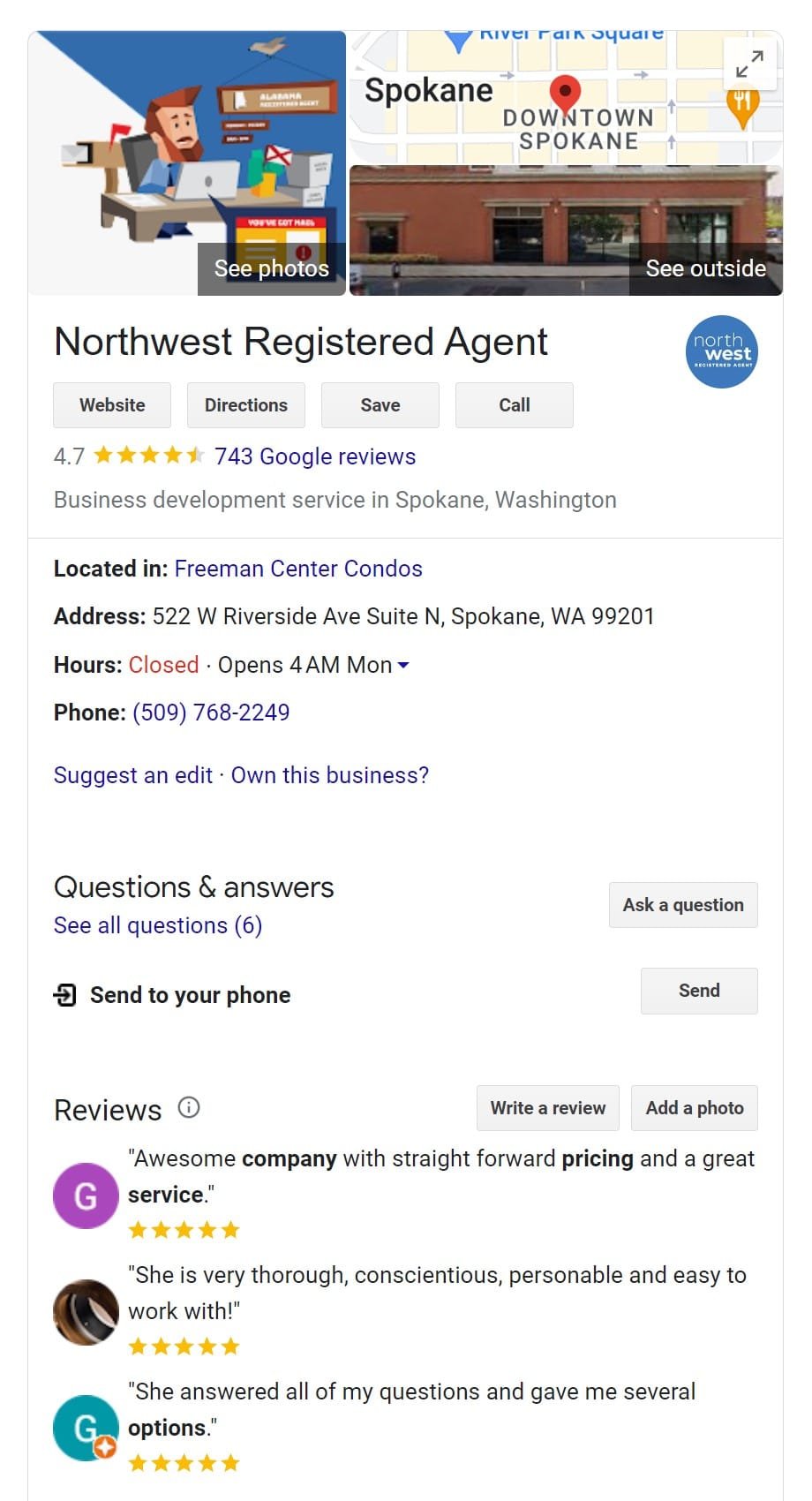

1. Northwest Registered Agent (Best LLC Service for Privacy)

Price:

My top pick for LLC formation service in Idaho is Northwest Registered Agent.

Northwest provides business formations and registered agent services. Northwest has been providing LLC formation services for over 20 years.

Northwest Registered Agent Reviews

They are known for exceptional customer service and are the industry leader in registered agent services. Idaho LLC formations with Northwest are discounted for our readers, just $39, and you also get a year of free registered agent service. This keeps your start-up costs low. Northwest is our top choice, and it’s an LLC service that puts customer service above all else.

Northwest RA Pros and Cons Pros

Cons

|

#2 Bizee (Best Budget LLC Service)

Bizee is another LLC service that has been in business for nearly 20 years. can be a great choice if you are concerned about start-up costs. They offer free Idaho LLC filing and registered agent services for the first year. A “free LLC” may be good for some, but Bizee needs to make money somehow. This can be done by upselling needed features at a lofty price. If privacy is important to you, Northwest emphasizes customer privacy more than any other LLC service I know. Bizee may not have as many bonus features as its competitors. Still, they offer all the essentials for an additional fee: filing an EIN and registering a DBA, filing annual reports, and others.

Bizee Pros and Cons Pros

Cons

|

#3 ZenBusiness (Best New LLC Service)

Thanks to competitive technology and a dedication to affordability, ZenBusiness has one of the most affordable LLC services available. Formations start at $0 plus the state fee. ZenBusiness provides Idaho registered agent services at an additional cost of $199/yr. You can choose the Pro package ($199 annually) for a flat annual fee to get business formation, and an operating agreement template.

ZenBusiness Pros and Cons Pros

Cons

|

#4 LegalZoom (Best for Ongoing Legal Services)

LegalZoom is a great way to get involved with a well-known brand. LegalZoom was founded in 2001 and has grown to offer hundreds of services. LegalZoom is more expensive than the other Idaho LLC services listed in this guide. LegalZoom is not the only option if you need a complete legal service. Rocket Lawyer is another option for LLC services and online legal services. LegalZoom gets pricey after the add-ons.

LegalZoom Pros and Cons Pros

Cons

|

More and more entrepreneurs are turning to LLC services for creating business entities. The number is in the millions. Bizee alone has helped create over 600,000 businesses.

It can be difficult to start a business. There is a lot to do, so many people become overwhelmed by the legal processes: filing taxes, obtaining business licenses and permits, and filling out the forms.

Idaho has requirements to ensure compliance, such as hiring a registered agent or filing annual reports.

LLC services handle most of the work for you. They simply need to know a little bit about you and your company, and they will start your business for you.

This is legal and allows you to concentrate on other aspects of your business. Many LLC services also offer registered agent services to help you maintain compliance.

Now let me point out a few more names in the online LLC formation space. I’m not recommending any of these other services. I’m just mentioning them for your consideration.

I have a personal story to tell

In 2008 I started a business and hired an attorney to do the LLC formation paperwork. I thought it would be complicated.

I paid $600 plus a $50 state fee to the lawyer in his office. The lawyer got on his computer, entered my name, and some basic information, and then printed out several pieces of paper and said “sign here and here”.

The whole process took about 10 minutes for $600. That same lawyer today probably charges $900 for these 10 minutes of work.

After that, I have only worked with online services.

LLC Formation Lawyers in Idaho

If your business is particularly complex, or if you don’t mind spending $100s of dollars more and want the peace of mind that comes with having an experienced business attorney to form your business entity, you could hire a lawyer instead of a formation service.

Business Attorneys in Idaho

As I just mentioned, hiring an attorney is more expensive than using an online LLC service, but you will obtain a level of competence and experience that can only be provided by an attorney.

I evaluated a long list of Idaho business attorneys on AVVO’s website to find the most qualified LLC formation lawyers.

From Avvo’s list of “best reviewed” business attorneys in Idaho, these are my top picks.

Tier 2 – Best LLC Service Reviews

Swyft Filings

![]()

Swyft Filings was launched in 2012 and are one of the latest services for LLC formation.

Prices start at $0 + state fee. If you need an EIN and LLC operating agreement, the price is $199 + state fee. Swyft Filings charges $199/year for registered agent services.

MyCompanyWorks

![]()

MyCompanyWorks has a basic LLC service package that costs $79 and includes assistance with Articles of Organization, Operating Agreement assistance, an online portal to store legal documents, compliance alerts, and assistance with registering with the Idaho Secretary of State.

They have maintained mostly positive reviews online. You will need to buy their premium package for $279 if you want a Idaho registered agent.

Inc Authority

![]()

Inc Authority, like Bizee, allows you to file your company formation paperwork free of charge, but each offer comes at an additional cost.

Ask the “free LLC” if they plan to sell your private information. I believe the “Free LLC” is a gimmick just to get you in the door. Yes, their filing service is “free” plus the state fee.

You will need to buy their $399 basic package if you require assistance drafting an Operating Agreement or accessing an EIN.

You will also need to buy their premium $799 package if you want to receive express processing.

Tailor Brands

Tailor Brands is a bit different than the others on my list.

Like their name says, they build brands. Tailor Brands promotes itself as a comprehensive business formation service that provides a complete list of services to entrepreneurs, including compliance and LLC formation, logo design, and branding features.

Tailor Brands offers three formation plans.

Incorporate.com

![]()

Incorporate.com offers a $99 base package that includes very few services, similar to Rocket Lawyer or LegalZoom. They offer an online account and assistance in filing your Articles of Organization, and that’s nothing else.

CorpNet

![]()

CorpNet has been in business for over 20 years. They will file the initial LLC documents and provide compliance alerts to maintain good standing with the Secretary of State. All for $79.

MyCorporation

![]()

MyCorporation is owned and operated by the check printing company Deluxe Corp. Their LLC formation services are like many others on our list.

They charge $133 to prepare your Operating Agreement and process your Articles of Organization. Each additional, comprehensive service comes at an additional cost.

Incorporate Fast

![]()

Incorporate Fast offers Idaho LLC formation services at a low $99 price. This includes assistance with filing documents, assistance with filing them, and an Operating Agreement template.

They offer “same-day” filings. They will process and file your documents within 24 hours of receipt.

If you can upgrade to their $199 package, you get an EIN.

BizFilings

![]()

BizFilings, another Idaho LLC service provider, charges $99 for the basic package. This includes assistance in filing your limited liability company formation documents and a year of their registered agent services.

Like each of the LLC services, they have additional features for additional fees.

Rocket Lawyer

Similar to LegalZoom, Rocket Lawyer offers online legal services. They also offer LLC services such as registering an agent, filing your formation documents, and an online document storage portal.

If you like having access to ongoing legal assistance for a fee, Rocket Lawyer might be a good fit for you.

Active Filings

![]()

Active Filings is another LLC formation service, they are based in Dania Beach, Florida. Active Filings has been in business since 2001 but is still a small player in this industry.

According to the company website, they have only four employees.

Direct Incorporation

![]()

Direct Incorporation offers the same LLC services that MyCorporation but includes a banking resolution as well as an Employer Identification number. They charge $174 for these services.

If you need an LLC operating agreement, you need to get the next package at $297. They also offer logo design, trademarks, a business website, and email.

InCorp

![]()

InCorp costs $99. plus state fees to file your Articles of Organization. Registered agent services are $129 per year.

National Incorporations

Nationwide Incorporators offers basic LLC filing services for $200, and for $475, you get an LLC operating agreement. You get to talk to an attorney. Pricey!

SunDoc Filings

SunDoc Filings has a $79 base package for filing your Articles of Organization. $70 for an EIN and $69 for an LLC operating agreement.

Best LLC Service Review Process

This is how I found the best LLC service in Idaho.

I formed an LLC a few years ago and did a lot of research before doing so. Because I have spent so much time on this subject, I believe I am very capable of finding and recommending the best LLC formation services. I also recommend using a registered agent service rather than being your own.

How did I research and choose the best LLC service in Idaho?

My research approach included these four steps to select the best Idaho LLC formation service.

Step 1: Reviews

I began by analyzing the reviews of online customers for the top 19 LLC services in Idaho.

I spent many nights scrolling through the customer feedback on Trustpilot and Google Business Profiles (among other review websites) to discover which LLC services were new, which seemed questionable, and which were legitimate.

Step 2: Website Analysis

Once I had a good idea of who I could trust, I could go to their websites and see exactly what they offered.

To find out who offered what products or business services, I looked through pricing pages and looked at detailed breakdowns.

Step 3: Talking with real customers

Online customer reviews are only one way to learn. To truly understand the experience of using a service, it is important to talk to the people who use it.

I sought out the opinions of customers who I had recommended to me over the years in order to get a clear understanding of Idaho LLC services. I wanted to know how easy the system was, how helpful and polite their support staff is, and how fast they process applications.

This direct feedback from customers helped me to see which promises were fakes and which were legitimate.

Step 4: Talking with their Sales Team

The last step was to talk to their sales team to find out how difficult they were with upsells.

I asked several questions that a first-timer would. Then I waited to see how many times I was encouraged to get additional services.

My Testing and Rating Criteria for Idaho LLC Services

While I was completing my investigative analysis, I was constantly evaluating these LLC formation services on the basis of these four aspects.

1: Features and Services

There are many steps involved in starting an LLC. If you have read at least half of the above, you will know this. Fill out and file your Articles of Organization. You will need an EIN to open bank accounts. Choose a premium registered agent in to get an address in Idaho. And a lot more.

To ensure you get as many completed projects as possible when you invest your money, I first assessed each LLC formation company on the business and product services they offer.

2: Pricing

I checked if they charge extra for a lot of pricey add-ons that are not mentioned at first. I liked the very clear services and upfront with everything. The best value LLC formation services rose to the top.

3: Ease of use

It’s a good idea to sign up for a business formation service that offers a variety of products at a reasonable price without any trouble navigating their system.

I created an account with each Idaho LLC formation service and attempted to register my fictional LLC. This was to ensure that all the systems were easy to use and simple to navigate.

4: Customer service

I was not satisfied with my customer service experiences after the recent corporate trend to outsource customer support to unaffiliated phone centers. These representatives know little about the service they are supporting and the laws and regulations that it is subject to.

I did my best to test their customer service teams to determine the quality of their business formation services.

I sent them polite questions, called them to inquire about obvious information, and jumped onto their online chat portals.

I also complained about inappropriate things. I wanted to know how they dealt with my comments and requests and how fast it took for them to reply.

Conclusion: Idaho LLC Fomation Services

My investigative analysis resulted in my picking Northwest Registered Agent as the best LLC service for Idaho.