Best Payroll Services for 2023

Want to get right to our top picks? Gusto, and OnPay, are two of the best payroll services in 2023.

Two crucial tasks that can make it difficult for business owners and HR managers are processing employee payroll and their tax obligations. Not only can it lead to fines and tax penalties, but it can also cause a loss of employee morale.

Our top 6 picks for best payroll service in 2023.

- Gusto

- OnPay

- Paychex

- Quickbooks

- Justworks

- ADP

The best way to manage these risks is to automate payroll using an online service. Each of the following solutions was selected for a specific reason.

All five top picks are available to perform everyday payroll tasks such as new hire reporting, scheduling, and security.

What makes them stand out is their performance in the most critical categories. These include employee self-service, reporting, tax management, and ease of administration.

We spoke to active users to learn how our recommendations worked in the real world. They explained the benefits and tradeoffs associated with each payroll service, giving us insights that we won’t get anywhere else.

#1 Gusto Payroll Service

ZenPayroll began life in 2012 as Gusto . Gusto was originally called ZenPayroll back in 2012.

Gusto is currently processing payroll for millions of businesses across the United States. Some have local workforces, while others are entirely remote, with employees spread across fifty states.

Gusto makes managing dispersed teams easy. The user interface is friendly and engaging, making it simple to pay employees, manage payroll, and provide benefits.

Gusto Pros and Cons

| PROS | CONS |

|---|---|

| Exceptional user experience | No time tracking features are included with the Core plan |

| Simple, intuitive payroll processing, even for novices | Sometimes the screens load slowly |

| Contractor-only version | |

| customizable reports | |

| Comprehensive mobile access |

Gusto Overview

Gusto payroll service works the same way as OnPay and focuses on the user experience. It makes complicated topics simple to manage and easy to use. It’s also fun, thanks to their humorous approach to design.

Gusto stands out from OnPay and others by approaching this while still providing core functionality for larger businesses. Gusto has a unique combination that combines ease-of-use with robust functionality, which is why I included it on my top five lists. It’s also why it’s the best choice for remote teams.

Here are the areas that Gusto stands out:

- Web-friendly: Managing remote employees can challenge employee onboarding and interaction. Gusto makes it easy for new businesses to get started. It also makes it easy and quick for employees to get started.

- Easy onboarding and recruiting: It is vital to streamline these processes if your business expands. Gusto is a fully automated system that allows you to quickly get new employees up and running. Gusto makes it easy to hire remote workers.

- Built-in time management tool (in tiers higher): You will need to subscribe to a higher-tier Gusto service to track your workforce’s time. Unlike OnPay, which offers only integrations but no native time tracking functionality. You can avoid the integration with a 3rd-party tool.

Users love Gusto for its clean, easy-to-navigate design. Gusto is loved for its cartoon illustrations and animated pigs, even though they may not appeal to everyone. According to one user, “Thank God we’ve got Gusto.” Look at how easy it is. Yay!”

It is simple to set up a checklist, create templates for essential documents like offer letters, and sign off digitally. Gusto makes it so straightforward for employers that in-person onboarding is fast becoming obsolete, even for localized employees.

Gusto is an HR manager of multiple $1 million companies. Gusto explained the changes in her company’s onboarding process to new employees. Her team produced an explainer video that explains how the tablet works. Instead of spending hours with a new hire explaining how the tablet works, her team just shared the video via Gusto.

A series of automated emails can be sent that guides the employee through every step of the onboarding procedure. This helps employees learn in manageable chunks and not get overwhelmed on the first day of work. The same goes for new employees, which is vital for remote workers.

Gusto is also easy to use for even the most inept of tech-savvy staff members, saving them time and energy dealing with common user problems.

Gusto gives you the flexibility to run payroll every month by offering unlimited payroll runs. Like OnPay, you aren’t locked into predetermined payroll cycles nor charged extra if payroll processing requirements increase. Gusto is flexible enough to adapt to changing circumstances or meet a single need.

Gusto allows you to automate your payroll. This is unlike OnPay. This is especially important for businesses with static payrolls, such as an all-salaried employee team.

Once you have created the initial payroll data, you can automatically set it up to run each pay cycle. Change something? It’s easy to turn the feature on or off with a toggle switch.

Gusto makes it simple to submit and manage local taxes if you have a business. Gusto excels here, as OnPay does not provide this option.

Gusto’s many pros combine to make it a powerful tool for dispersed workforces.

Gusto Needs Improvement

Gusto’s many strengths are not without their flaws.

- Gusto needs some improvements in customer service. Users have consistently complained that they are slow to answer their initial calls, but it can take multiple calls over several days and weeks before the problem is resolved.

- Gusto claims that integrations are complex with “your favorite software” and lists more than 100 third-party tools. But user experience tells a whole different story. Gusto’s integrations with popular accounting packages like FreshBooks, Sage, and Xero were problematic.

- On the basic plan, there are no PTO requests. OnPay users must sign up for a higher-tiered, more expensive plan to access the same PTO functionality.

Gusto HSA/FSA benefits and payroll are not available everywhere. Payroll and 401k are available across the United States. However, HSAs/FSAs are only available in 38 US states and DC. Gusto will not help your business or employees if they are still uncovered in one of the 12 states.

Gusto’s payroll service uses an optimized website for mobile use, just like OnPay. While it’s not an issue, I am interested in seeing it.

Gusto offers a restricted employee-facing app called Gusto Wallet. This allows employees to access their pay information as well as tax documents. Everything else must be done on the Gusto website.

Gusto’s problems integrating third-party applications, especially accounting software, is perhaps the most surprising aspect of our research. Gusto’s integration with Xero was a challenge.

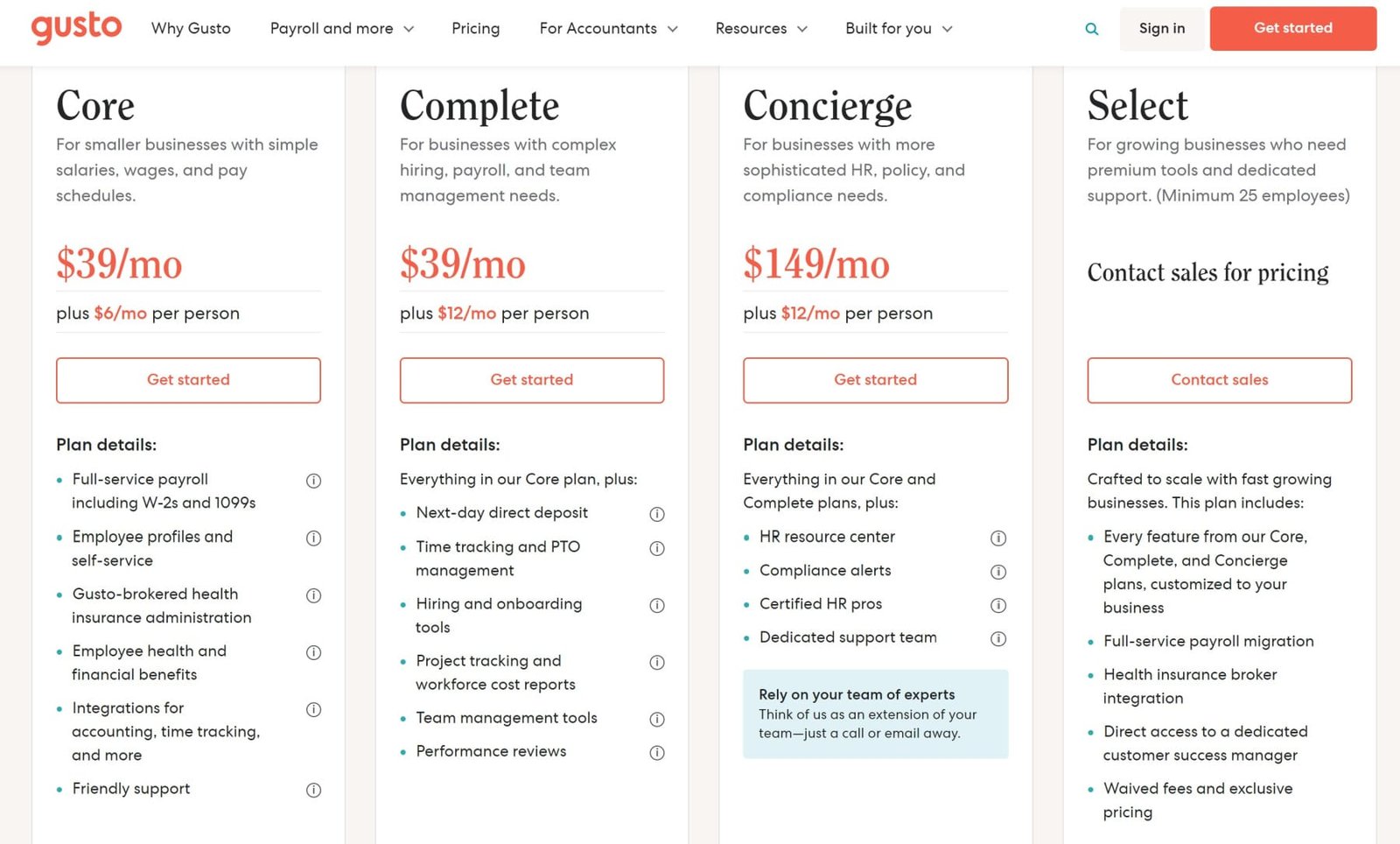

Gusto Pricing

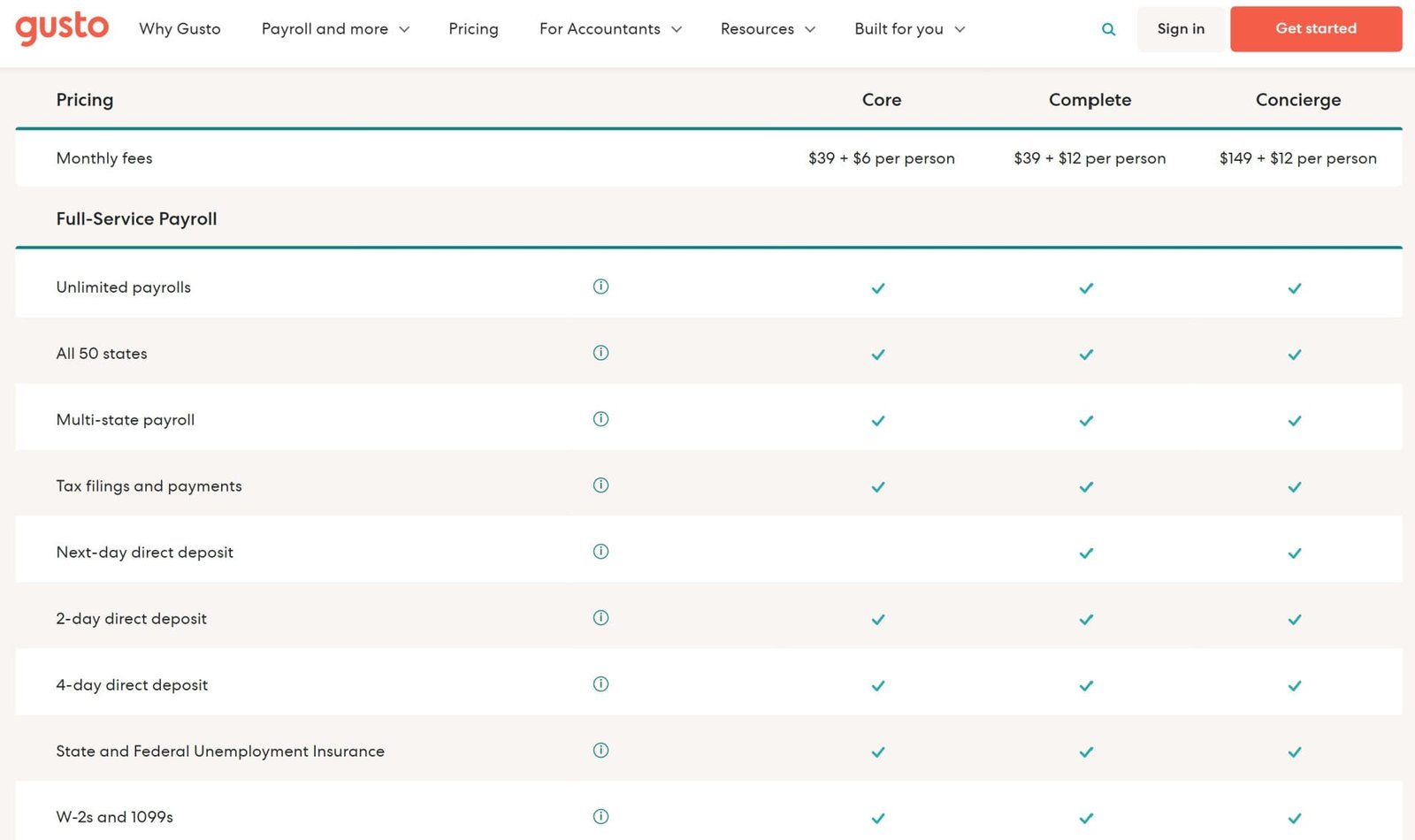

Gusto is a traditional pricing system, like ADP, Paychex, or QuickBooks Payroll. It offers multiple levels of service in contrast to OnPay’s one-price approach.

Gusto’s payroll service provides three tiers of service: Core and Complete. A concierge is also available. Each one costs a flat monthly fee per employee. The Select option offers complete customization, including price.

- Core– $39/month plus $6 each employee per month. The Core includes employee self-services, worker’s injury administration, and worker health benefits administration. This basic tier, unlike OnPay, has no PTO nor time tracking.

- Complete – $39 per month plus $12 per employee. This tier has all Core features and employee offers and onboarding, tracking time, time-off requests, and a survey.

- Concierge is $149/month plus $12/per month for each employee. All Core and Concierge features are included, including access to certified HR professionals and an HR resource center.

Gusto lets you add on a la carte services, no matter what package you choose.

- 401(k), Plans

- 529 college savings programs

- HSAs and FSAs (not available in all States)

- Workers compensation

Gusto is unique because it offers a contractor-only option for companies without employees on W-2. It is $6 per month and has limited services.

- Unlimited contractor payments in every 50 states

- 4-day direct deposit

- 1099-NECs

- Reporting new hires as required

Gusto allows you to try it for free for 30 days.

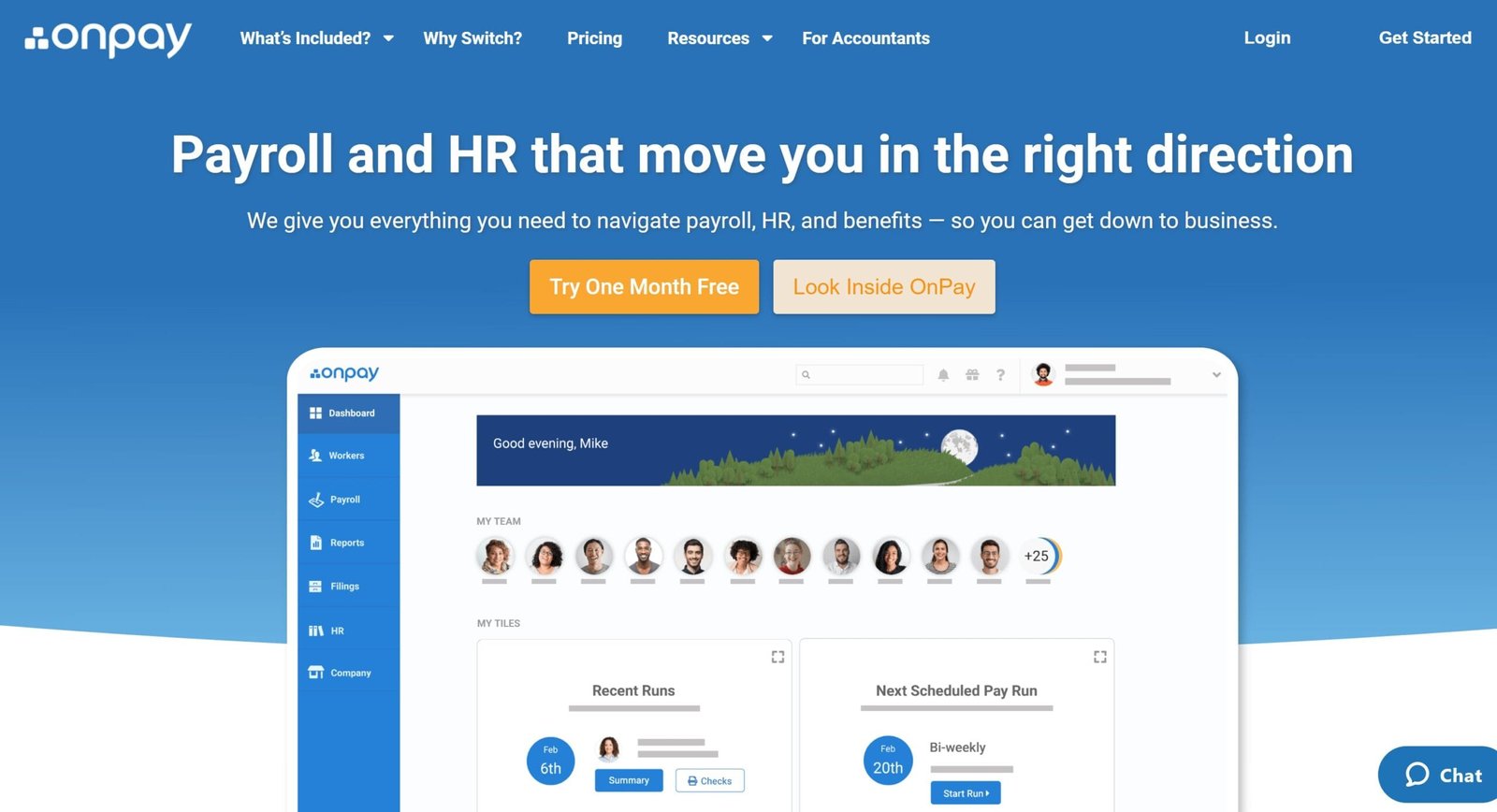

#2 OnPay Payroll Service

OnPay was developed as an internal solution that would simplify the payroll process for one family. OnPay is a top-rated payroll service that has been in existence for ten years.

OnPay is my favorite payroll company because of its ability to simplify complex payroll issues.

No HR or payroll specialist? No problem. OnPay helps everyone master payroll management, no matter how much experience they have.

OnPay Overview

OnPay has several key features that make it ideal for new payroll users.

- OnPay simplifies payroll administration: OnPay focuses on making payroll understandable and straightforward. This makes it a tool that anyone can use. You don’t need to be a skilled HR professional for each month of payroll success.

- OnPay’s website allows for easy employee onboarding and access. Most common tasks such as self-onboarding or reviewing payroll documents are quickly completed. This helps the employee to feel less frustrated, and the employer saves time.

- Stellar customer services OnPay’s focus is to simplify payroll for everyone. So it makes sense that they have a strong focus on helping their customers. OnPay solves problems quickly and effectively, unlike many competitors, with no long hold times.

OnPay was user-friendly, especially for those with little or no HR experience.

OnPay Pros and Cons

| PROS | CONS |

|---|---|

| Fast payroll processing | Mobile version missing some functions |

| Unlimited payrolls, flexible frequency | |

| Top-quality customer service | |

| Great user experience | |

| New time tracking features |

OnPay also scores high on the employee side. According to all reviews, employees can access the platform quickly and navigate it with ease. They can self onboard, print paystubs, change tax forms, and even make their payroll.

This is a significant benefit for small companies that don’t have an HR department. It eliminates the repetitive questions and tasks, generally associated with these activities.

OnPay offers the most basic HR tools for small businesses, such as an automated onboarding process, PTO tracking, and compliance reporting.

OnPay is compatible with a limited number of third-party apps for compliance, time management, and accounting. OnPay, however, has the fewest integrations with third-party apps of any product in my top five.

OnPay also offers an easy way to connect two tools in OnPay’s existing integration list.

OnPay offers fast and accurate answers when you have questions.

OnPay also excels at reporting functionality, particularly the prebuilt reports. OnPay reports are simple to find and use according to the users we interviewed and their reviews online.

OnPay offers a Report Designer option that makes it easy for users to create customized reports. Drag and drop functionality allows you to move up to 50 data items, add columns, adjust dates, set filters, and create custom views.

OnPay’s flexibility extends to your payroll cycles. OnPay offers unlimited payroll cycles, a significant advantage over other providers on my list.

OnPay, in general, delivers the best results by taking the guesswork and confusion out of payroll.

Where OnPay Can Help You Improve

OnPay, like all online payroll services, is not perfect. The software’s emphasis on simplicity in payroll creates gaps in functionality. These gaps can be significant or not, depending on your needs.

- There’s no automatic payroll option. OnPay offers unlimited payroll cycles each month. However, the feature is not set and forgotten. Each cycle, payroll must be manually approved. All five top products can do it.

- Some functionality may be hard to understand: Although the website is simple, many users have reported excessive complexity in certain areas. This includes onboarding and extracting specific information.

- Integrations limit. OnPay integrates with only a handful of third-party tools listed on its website. At the time of writing, there were just 20 third-party software options. These products offer a much more comprehensive range of integrations than any other.

One of the most notable deficiencies is that a payroll administrator cannot set up payroll and run it automatically. OnPay will require you to manually go through two confirmation pages and screen screens each time you run payroll.

This may not be a problem for small businesses with few employees or a volatile payroll. However, this could quickly become a significant problem for large companies with many salaried employees. Gusto, Paychex, ADP, and Gusto are examples of products that offer this same set-it-and-forget-it convenience.

OnPay attempts to be simple to use, but users often have trouble or encounter unnecessary irritations.

Additionally, administrators and employees are not able to use the mobile app. OnPay claims its website lets users run payroll from anywhere using “just one bar” of reception. However, a well-designed and intuitive app makes things much more manageable. Both Paychex & ADP have mobile apps. Gusto has a limited app for employee self-service.

This is a unique issue for businesses located in municipalities that have municipal taxes. OnPay doesn’t manage local taxes. This means that a payroll company that can manage them is required. All the other options in my selection offer this service.

OnPay’s 20-plus integrations with third-party apps are the final straw. This puts it far behind the competition. This is a big problem for OnPay users that already use accounting, time management, or other tools not on the list.

OnPay Pricing

OnPay excels when it comes to pricing. There are many reasons why. Forget complicated pricing plans and personalized quotes. OnPay is the only provider that offers all its services monthly. I consider it to be one of the best options for my budget.

Users love their pricing approach. The small health care clinic owner says that the service is an excellent value for small businesses.

OnPay costs $36 per calendar month plus $4 per head per month. That’s it. No contracts. No hidden charges. No uncertainty.

OnPay has an easy calculator online that shows you precisely what you will be paying without ever needing to speak to one of their sales representatives.

#2 Paychex Payroll Service

Paychex has been one of my top 5 list heavyweights. Paychex is a service that has been around since the beginning of time. Workers have seen it on paycheck stubs for generations.

Paychex was founded in 1950 and has since expanded to offer a wide range of benefits, payroll, HR, and time tracking services.

This solid service offering speaks to Paychex’s best market. Paychex will happily take on small businesses with fewer than ten workers, but their true forte is larger businesses with many employees and dedicated HR personnel.

Paychex’s focus is a big difference from Gusto or OnPay, on the aesthetics of the service and the hand-holding that Paychex offers to the inexperienced user. Instead, they provide services that cater to complex payroll and HR needs.

Paychex Payroll Pros and Cons

| PROS | CONS |

|---|---|

|

Powerful real-time analytics |

Hidden fees for setup &setuptax docs |

|

Payroll automation features |

Mixed reviews from users regarding support |

| Direct deposit, paper checks, and paycards | |

| Salary, hourly, and contract workers | |

|

PTO and benefits management |

Paychex Payroll Overview

- Advanced customer services A big company can offer 24/7 customer care, and Paychex delivers. A dedicated payroll specialist is available for every customer on the higher subscription tiers. This specialist serves as the point person for all customer inquiries.

- Paychex employees have excellent knowledge of payroll tax law. Paychex staff are equipped to handle tax laws at all levels, including the local level. They do. ADP, Paychex’s heavyweight counterpart on the list, cannot do the same.

- Integrated tracking services: Paychex makes it easy to track employee hours, regardless of which service level you purchase. Their Time Clock feature is similar to a traditional punch in/punchout system. Paychex Flex Time – a more robust, cloud-based time/attendance solution – is also available. Both time management tools seamlessly transmit data to payroll or HR systems.

It was amazing to see how passionate Paychex users were regarding customer service. They also noted that problems are resolved quickly. This applies to all levels and not just the dedicated payroll specialist. Even if companies do not choose a tier that assigns a specialist, they still receive exceptional service.

Paychex receives high marks when it comes correct processing of taxes. Paychex is an established company and can ensure that tax changes at the local level are dealt with.

According to the owner, a 100-person-strong firm, Massachusetts recently introduced a paid family and medical leave program that is state-funded. “So that turned out to be a new payroll tax, and Paychex handled this without any issues.”

Paychex quickly resolves customer problems when they occur. Paychex also credited the customer with several months’ worth of fees to make up for their inconvenience.

Paychex also focuses on the mobile side of payroll in 2 ways. Paychex, unlike Gusto and OnPay, offers administrators a mobile app. This allows admins the ability to process payroll remotely from their mobile devices.

Paychex also offers time-tracking options that apply to both mobile and local workforces.

Paychex users say that “One of the major reasons we moved to Paychex” was the ability to access the online Time Clock. “It is beneficial to have an automated system that allows you to check-in and checkout. This makes it much easier to manage. It is time-saving.”

Paychex users are pleased with the reporting component of their payroll service. Paychex users particularly loved the integrated Payroll Journal feature and the Employee Earnings report.

Users also noted that custom reporting was made easy by the drag-and-drop feature. This feature is the best among custom reporting across all products.

Paychex understands and meets the needs of its target audience.

Paychex’s Potential Improvements

Paychex does a fantastic job overall, but there are still areas that could stand for improvement to eliminate some recurring complaints.

- The user interface is complex. Although it’s simpler than OnPay, Gusto, or Gusto, the design is still fundamental. However, Paychex makes it more complicated by offering too many options. This shows that they are not targeting HR pros looking for hand-holding but experienced HR professionals. Paychex will not be difficult for an experienced HR professional, but users with less experience may find it challenging.

- Paychex is compatible with most other tools, despite having a lot of integrations. Users have noted that it is more challenging to interact than they might expect.

- Pricing is very secret. Paychex keeps pricing secrets private. Paychex will make you jump through hoops to locate pricing and packages. This is unlike any of the services on this list. Instead, they invite you to register for a consultation and get a quote.

When learning about new software for payroll, there are two kinds of people. Those who know a lot about it and are eager to learn more, and those that are brand new to the subject and want more personal attention.

Paychex is a tool for the former. One interviewee said so when we were discussing onboarding new employees.

“My issue, just that I haven’t been handed anything that states’ here’s what it should all look like from beginning to end,” she stated. “It would have been nice to have it all.”

The administrator user interface is also quite primary. However, it can still confuse. Experiential HR personnel will likely jump in and have a blast, while someone new to payroll and HR might feel overwhelmed by the number of options. It’s not impossible, but it might take a few payroll cycles before it feels natural.

I was surprised by the number of user complaints regarding specific complex integrations, especially regarding time tracking software. Paychex customers might find it more challenging to integrate specific software.

Paychex also has their own time in reporting products, one user demonstrated. We don’t use that…because our DCA-approved product is already in place. Paychex is most likely DCA-approved, but why bother. Why duplicate the wheel? So we have a different system, and I have the PTO entered manually to Paychex.

Paychex is quite opaque when it comes to sharing prices online. We were all surprised that they don’t share price information online.

Paychex users have told us, “That’s probably one my biggest complaints working with Paychex.” “They do promote a low upfront fee because they incorporate several discounts, but those discounts over time just disappear.”

The Paychex team also came under scrutiny. Numerous reviews criticize Paychex for its aggressive sales efforts, including repeated calls and emails to existing customers. Paychex salespeople seem just plain pushy. They leave a lot to be desired in their sales tactics, even for current customers.

Paychex’s other user, who we interviewed, stated that “the only issue I have had with their salespeople.” These complaints are not found in any other product.

Paychex Pricing

Paychex pricing information is like trying to find the holy grail. It may be out there somewhere, but it is tough to find. You feel terrific when you find it.

This is an entirely new approach than Gusto or OnPay, which put their pricing front of mind.

- Flex Essentials – $39 per month + $5 per employee. The basics. Provides fewer services at a greater cost than OnPay or Gusto.

- Flex Choose– a custom quote only. All the Flex Essentials Services, plus a dedicated staff payroll specialist, a mobile app that allows payroll administrators to access learning services, and more options for employee pay.

- Flex Pro Customized quote only. Select and Essentials, plus certain services only available to larger businesses. This tier is required to access services such as garnishments and accounting integrations, which are available at lower prices than those offered by the top five.

- Paychex has occasional specials that offer three months of free service, although there is no free 30-day trial. But, these specials will require you to search.

Paychex pricing can be dangerous, as many user reviews confirm. Prices can quickly rise, especially if a la carte services and products are added. Some users leave the service due to rising prices.

#4 Quickbooks Payroll Service

You can’t underestimate the power and impact of a brand. QuickBooks is easily recognizable as an accounting software product.

The company’s reputation for reliability and ease of use has been earned over many decades. This reputation extends QuickBooks payroll.

It’s no surprise that QuickBooks Payroll can be used to integrate with QuickBooks accounting software. It’s easy to integrate the two within QuickBooks accounting software.

But QuickBooks Payroll is also perfect for any small business that wants a standalone, trimmed-down product for payroll management–something that’s easy to use and gets the job done without unnecessary bells and whistles.

QuickBooks is a simple payroll services package that individuals or small businesses can use.

QuickBooks Payroll Pros and Cons

| PROS | CONS |

|---|---|

| Smooth payroll process | Expensive |

| Excellent tax knowledge, flexible payroll, and tax handling | Could use more online help |

| Deep integration with QuickBooks Online and QuickBooks Time | Mobile app missing some functions |

| East custom reporting | |

| New Payroll Tax Center |

QuickBooks Payroll Overview

QuickBooks Payroll provides various unique features ideal for solopreneurs or business owners who have to manage small teams.

- QuickBooks Payments is an excellent tool to make it easy for people who have little or no experience in payroll to get their employees paid. The Payroll Tax Center dashboard simplifies the process. Very intuitive.

- Protection against tax penalties: Uniquely among my products, QuickBooks Payroll offers absolute monetary protection (up to $25,000 annually) to cover taxes penalties, and interest. Although you need to be on the most expensive tier for this coverage, small businesses can still benefit from this type of insurance.

- Time tracking is made simple: QuickBooks Time allows users to track time via the web or a dedicated mobile application. After collecting the data, they can feed it back into QuickBooks Payroll.

All users interviewed used QuickBooks payroll in conjunction with QuickBooks. The users all agreed that QuickBooks Payroll had saved them a lot of time every month. It also cut down on expenses.

QuickBooks Payroll can offer tax penalty protection for users who are willing and able to pay a little more each month. Things can quickly become sticky when you’re on IRS’s radar. Your payroll software can have your back, so it is worth paying extra for a higher-tier package.

The reviews we read and the users we spoke to praised the prebuilt report. Even though 20 ready-to-go reports may not seem like much to users with simple needs, they provide a nice compromise between covering all the basics and overloading them with too many options.

This is also a significant win. The QuickBooks Time iOS and Android mobile apps allow you to track hours accurately no matter where or when employees work. It even has built-in geofencing technology, something rare among our top 5 products.

QuickBooks Time is very user-friendly and flexible. One user even made it an internal tool to track billable hours for clients.

QuickBooks Time is an a la carte option available at the lowest QuickBooks Payroll subscription tier. The higher tiers include QuickBooks Time.

QuickBooks Payroll: Where it could be improved

QuickBooks Payroll works well for many things but not all.

- Regional integrations – If you do not use QuickBooks Online to manage your finances, the number of third-party programs you can integrate QuickBooks Payroll into is limited. Intuit products are not compatible with each other.

- Poor customer service: Slow response, slow follow-up, and problematic contact were some of our comments about QuickBooks customer service.

- Fewer HR tools.QuickBooks Payroll has a lower level of functionality than the other top five. This is an issue for users who want both payroll AND HR.

QuickBooks Payroll has a significant problem. QuickBooks Payroll’s 650+ third-party integrations are not available without it. It is too restrictive for people who aren’t already using or want to use QuickBooks for accounting purposes.

QuickBooks Payroll users cannot also integrate with any other accounting program. It’s a significant limitation for anyone who needs to do more than basic payroll.

QuickBooks Payroll ranks among the lowest customer service out of all five products. Numerous customer reviews consistently highlight poor customer service, including long wait times.

“If you have a QuickBooks problem and you try calling them, you’re going be on the phone forever trying to get help,” stated one person we interviewed.

Users are often forced to use third-party resources to get more information when unexpected problems occur. One interviewee witnessed this first-hand.

“The direct deposit payment was supposed for the 30th of January, but it wasn’t there,” he said. “I sent it, then discovered via the [QuickBook] forums it was a QuickBooks issue.”

Many users are unhappy with employees’ inability to get paid or with tax-related issues with IRS. These complaints can be traced back to 2016. This, combined with poor customer service, can be frustrating for a payroll manager.

The lack of HR tools is another issue. ADP and Paychex do not offer higher-level benefits to employees. Gusto’s OnPay offer doesn’t provide an easy and enjoyable onboarding experience.

QuickBooks Payroll’s highest-tier plans are not available for you. This plan is more expensive than OnPay, Gusto, or Gusto. You can only capture a limited amount of these services.

Some businesses may have problems with tax calculations. QuickBooks Payroll needs manual entries from workers who provide services in multiple states.

The same applies to employees who move often. QuickBooks Payroll can only keep track of up to two states. QuickBooks Payroll cannot track multiple states, so it might be difficult for you to use QuickBooks Payroll.

This issue is unlikely to affect most solopreneurs or small companies. However, it shows how QuickBooks Payroll can be problematic for large businesses with many employees.

QuickBooks Payroll Pricing

QuickBooks Payroll offers the most affordable pricing on our list. This includes a 50% discount for the first three months. Only OnPay costs less once the three-month discount has been removed.

QuickBooks Payroll’s low cost makes it an attractive option for small businesses or individuals who want to manage a small payroll but don’t want to pay extra for features.

QuickBooks Payroll has transparent pricing, keeping with its goal of targeting small businesses and individuals. It makes it simple for anyone to easily understand options and get started with service within a matter of clicks.

Paychex has a special deal for you if you sign-up today. You can find regular pricing here:

- Core – $45/mo plus $4/employee. This plan offers the entry-level plan, including auto payroll, 1099 electronic file and pay, product support, next-day direct deposit, and auto payroll.

- Premium – $75/mo plus $8/employee. All Core offerings, plus same day direct deposit, payroll review by an expert, and mobile time tracker

- Elite – $125/mo plus $10/employee. All Core and Premium offerings, plus expert setup, setup time tracking. 24/7 support. HR advisory services.

QuickBooks Payroll offers additional services at a severance, such as:

- 401(k), plans

- Health benefits

- Time tracking app

- Administration of worker’s pay (for higher tiers only).

- HR support center (for higher tiers only).

QuickBooks Payroll gives you a 30-day complimentary trial. You also get 50% off your first three months of subscription.

Quickbooks is the leading name in the payroll industry. It provides comprehensive payroll, HR, and human capital management services. It has worked hard for more than 70 years to perfect its craft.

ADP, which provides every type of payroll-related service to businesses, is far and away from the most feature-rich product in my top 5. ADP has the most viable solution for you if you have any questions or need to track anything related to payroll or human resources in your company.

#5 JustWorks Payroll Service

Justworks, a professional employer organization (PEO), will manage your payroll for you. PEOs have the disadvantage that your employees become employees of the PEO, and you can less control what happens. Justworks is the best outsourcing payroll service due to its simplicity, pricing, and the variety of HR functions it can outsource with payroll.

Justworks Pros and Cons

| PROS | CONS |

|---|---|

|

Benefits Management |

Limited third-party integrations |

|

Employee Self Service |

|

|

Direct Deposit |

|

|

Justworks can be used in all 50 states. |

Justworks Overview

Here is a detailed description of Justworks’ payroll service:

- Pricing: Prices range from $39 to $49 per person per month, depending upon how many people you have.

- Easy of Use: The easiest, because you don’t have to do much other than pointing your employees at Justworks to sign up

- Tax ServicesHandles all W2/1099 and employer payroll tax filings

- Year-End Fees: All year-end W2s, 1099s online, and all year-end W2s are included in the price

- Accounting Integrations –QuickBooks, Xero, and other API options

Justworks is known for its excellent customer service. Support is available via email, phone, Slack, and chat 24/7. You can also find helpful articles and other content to help your employees with any problems they might be having with the service.

#6 ADP

ADP is a leader in the field of payroll services.

ADP Pros and Cons

PROS |

CONS |

|---|---|

|

Scalable with several plan options |

Pricing isn’t transparent. |

|

Robust reporting, including customization |

Confusing onboarding process |

|

Lots of HR add-ons |

Several fees, including for setup |

| Setup brand name and reputation | |

ADP Overview

You achieve this by winning many times over. Here are the top ADP features:

- Flexible payroll processing: ADP enables you to create and segment payrolls for any size group, set custom payments dates, and modify custom fields with no limitations. ADP is the clear leader amongst all five.

- Mobile apps are galore. DP offers Android and iOS for the employee and admin sides. Employees can access their information on-demand. Administrators can manage payroll and human resources from any place and at any time, on any device.

- Integrations don’t end there. ADP lists hundreds and thousands of third-party integrations it supports, ranging in complexity from essential accounting software to enterprise resource planning software. The leader in the field.

Payroll automation is one evident area. ADP is an automated tool designed to help your business grow at any stage. ADP will manage your more complicated payroll needs no matter how straightforward your payroll plans might be.

ADP also allows for easy changes to your payroll data, such as the case of one college payroll administrator.

“Every semester, we have to replace it,” one user stated. “It’s so easy and user-friendly. The best part? It is self-explanatory.

ADP also makes employee onboarding simple. Although the interface isn’t flashy like Gusto’s, it is very straightforward. It’s a good interface, and it does the job.

“We had no issues. Both administrators and employees find it simple to use. In terms of getting employees onto ADP following a Paychex switch, an administrator claimed she did not receive one email.

ADP also stands out in the mobile app area. There are separate apps available for administrators as well as employees. ADP Mobile Solutions takes the complexity out of managing your business and simplifies it for everyone. This is a standout product that I’ve featured here.

ADP is highly flexible when it comes to integrations. ADP also offers hundreds of listed third-party products that you can integrate with your payroll service if there isn’t an ADP product that does what you need.

You won’t be disappointed with the number of tools available.

ADP Payrolls Could Be Improved

- A lack of guidance during the onboarding process: Despite its robust functionality, ADP isn’t the easiest option for a new company we want to work with. Users and reviews have expressed concern about the steep learning curve and lack of support during onboarding.

- Custom reporting is difficult to use. Users frequently complain about inconsistencies in fields, slow system performance, or results that they did not expect. ADPs prebuilt reports work well, but the custom reports are not.

- ADP is different from Paychex. While pricing for its most basic package can be found online, ADP offers no pricing information. Secret pricing ADP requires contacting a sales rep to get a customized price quote.

ADP is not the right choice for those who don’t want to be guided throughout the onboarding process. ADP users felt free and independent, as opposed to OnPay or Gusto.

“We were not given the guidance as to how to implement this system,” one user commented, referring specifically to her initial company onboarding experience.

This lack of guidance might not be an issue for a seasoned HR professional, but it may be a problem for someone unfamiliar with payroll. OnPay and Gusto are better options for those new to the field.

ADP’s weakness in taxes is another. Several reviews were conducted over the past twelve months. They claimed that ADP had missed any law changes or compliance rules and caused an issue. These were the complaints of both current and former ADP users.

We often heard of the difficulty in using custom reporting in reviews and during interviews. In some cases, customer complaints were so severe that they forced them to change payroll providers.

One user that left said this. “That was the biggest thing I had issues with about ADP,” she said. Custom reports weren’t intuitive and were challenging to use. There were a lot of reports I could run that would work, but it was the custom ones that became a little more complicated.

ADP also offers the most detailed pricing information out of all products. ADP does not have any pricing information available online. You will need to contact a salesperson in order to design a package to suit your business needs. This is quite different from how QuickBooks, Gusto, and OnPay present services.

ADP is not like Paychex in that they are known for pushing salespeople. ADP users frequently complain about being oversold. ADP will require you to speak to a sales rep.

You might not get what you expect from a sales representative when you actually engage with them. “During negotiations, the sales representative said, “Oh yeah, you could do that,” and we found out later that it wasn’t possible,” said one user.

ADP Pricing

ADP offers similar services to Paychex. ADP requires you to provide your contact information to get the ball rolling. This might be an attractive option for small businesses looking for simple, cost-effective payroll services.

You might not expect it if your job is as a payroll/HR manager in a larger company. Negotiating procured services is part of the job description. ADP does not list small businesses on its website as a target audience. Instead, they want mid-to large-sized customers.

ADP is still keen to appeal to businesses of all sizes and offers two tiers. Each tier offers different packages.

We found basic information about RUN. You don’t even have to look through ADP’s website or give away your personal information.

- Four levels are offered in RUN. Each level offers more services.

- RUN Essential – $59/month plus $4 per person per month. Includes payroll processing, reporting, direct deposit

- RUN Enhanced is available, Run Complete is available, and Run HR Pro can be ordered by consultation.

ADP Workforce Now is an option for businesses with 50 or more employees.

Workforce Now includes all RUN functions and compliance reports and tailored service. It also allows for country-specific record-keeping and implementation. Only consultation is necessary to establish the pricing.

The Payroll Services Review Process

To make it on my list, there were many criteria that each product had.

It had to meet these requirements for any software to earn a place among the top 5.

- Consolidate and offer integrations. This is a way to streamline payroll operations and reduce the number necessary to complete basic payroll-related tasks like onboarding, tax, payroll, and taxes. A tool must seamlessly integrate with other tools to do all the tasks.

- Be broadly used. There are many excellent payroll automation tools on the market, but some are only used in niche markets. I selected tools that are commonly used by small to medium-sized businesses with basic payroll needs.

- High ranking in user reviews. Every software has its flaws. But it’s important to distinguish between a problem that is just a minor issue and one that is simply a significant problem. I immediately canceled any online payroll services with poor reviews.

- Has an established online presence. There are certainly some unicorns when it comes to payroll processing. However, if you can’t find any discussion online about them or if no one has reviewed them, it’s difficult for us to see if they are worth the hype. I did not consider a tool that didn’t receive regular mentions on major product review websites and other internet resources.

Apart from the above, the top five software programs I included all efficiently manage basic payroll management tasks. These requirements are essential:

- Security. Protecting personal information is a top priority. I’ve selected high-level security tools to help me do this.

- Scalability. Any online payroll service should allow you to grow along with your company. Each tool in my list may not be able to take your business to enterprise levels, but they can all keep up with changes in your company.

- Payroll Scheduling: All of my top choices can handle a range of standard payroll schedules such as monthly, bimonthly, weekly, and bi-weekly.

- They were reporting a new hire. Since alerting the government when a worker is added to your staff is a legal requirement, I needed to ensure that every top choice did this.

What was excluded

- My research and evaluation focused primarily on tools used by small- to medium-sized enterprises with less than 1,000 employees. We targeted enterprise companies. If the tool can be scaled to the enterprise level, I did not forget about it in my review.

- Was niche-focused. Although some of the services here are designed for certain types of businesses (farms/churches, restaurants), I believe that all five of my top choices can be used by any business regardless of its industry.

6 Best Payroll Services for Small Business 2023