Our Gusto review covers their payroll plans, pricing, features, customer reviews, and how Gusto compares with other leading payroll providers.

Gusto is a top-rated product for its simple-to-use payroll software and human resource tool. Although its pricing is not the most affordable for payroll or HR software, Gusto includes many features that aren’t available with comparable providers.

Visit Gusto

https://gusto.com

Gusto is a time-saving tool for small businesses that streamlines the tedious tasks of employee payroll, onboarding, and benefits. It’s cloud-based so it can be accessed anywhere via an internet browser. You can upgrade or downgrade your plan easily if you require new features or don’t use them.

Designed for small businesses, Gusto streamlines time-consuming tasks related to employee payroll, onboarding, benefits, and support. Because it’s cloud-based, it can be accessed from virtually anywhere through an online browser. And if you need new features or aren’t using others, you can easily upgrade or downgrade your plan.

Gusto Payroll Review: Overview

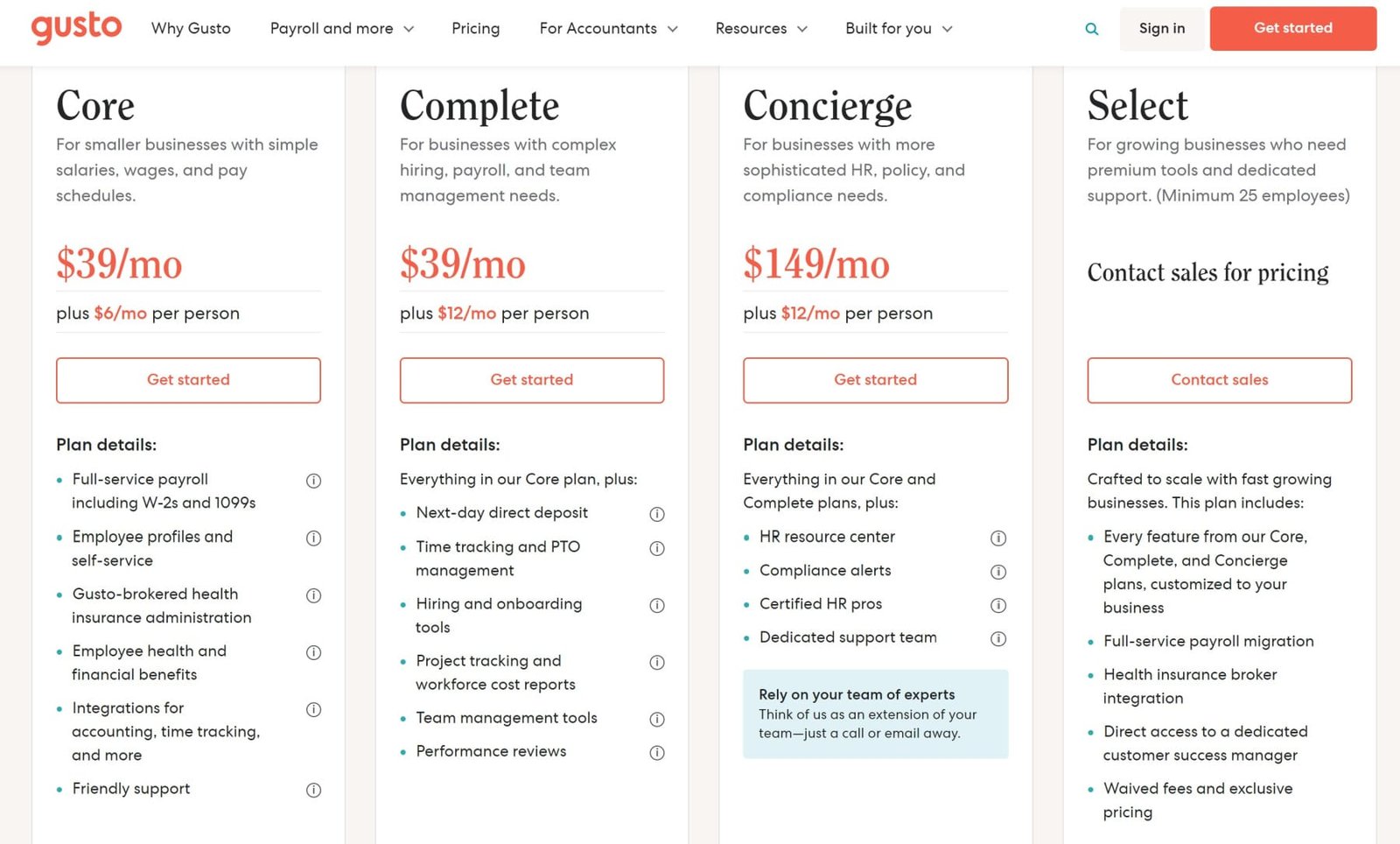

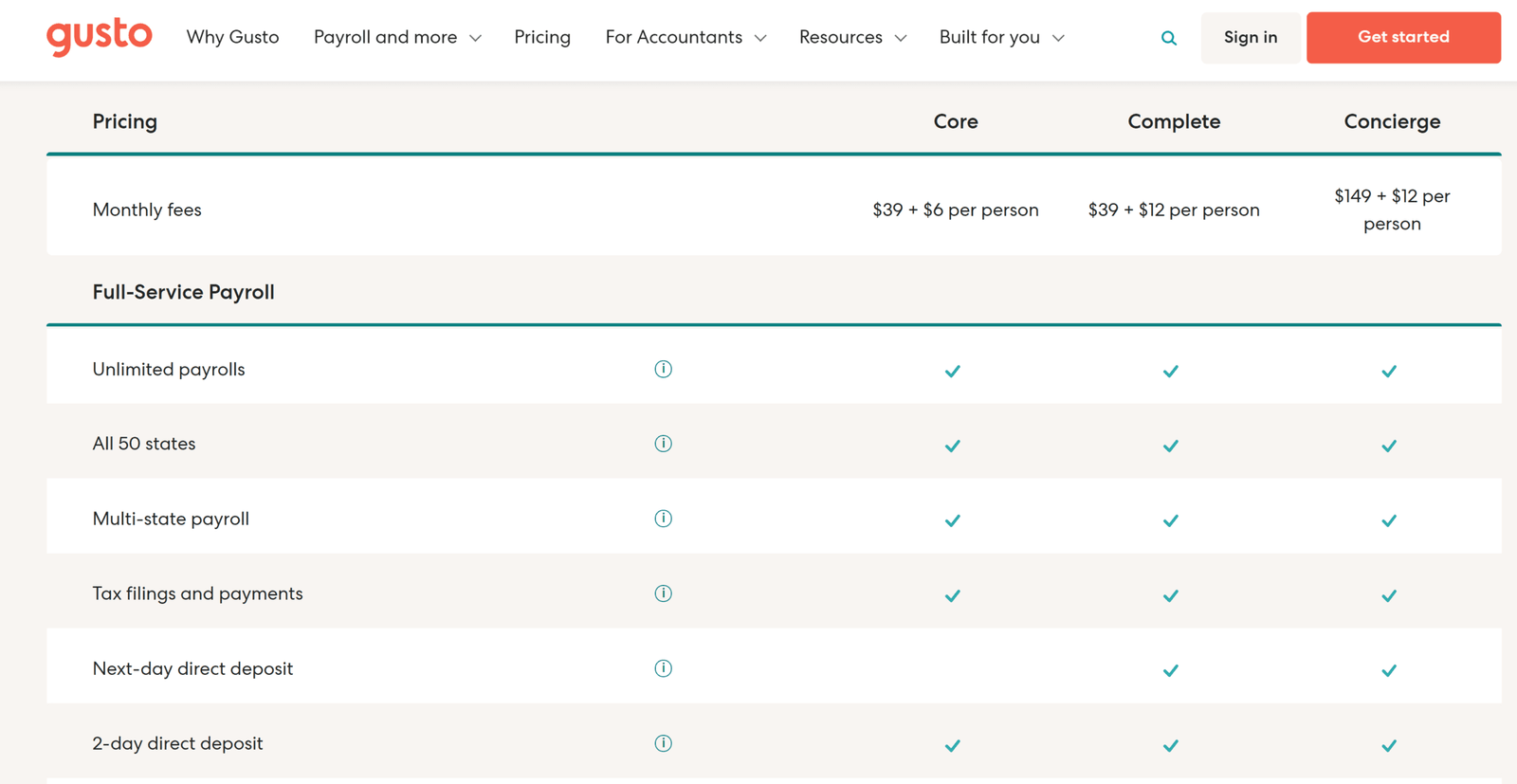

| Price | Pricing plans: Core — $6/month per person; $39/month base price. Complete — $12/month per person; $39/month base price. Concierge — $12/month per person; $149/month base price. Contractor — $6/month per person; $0/month base price. |

| Tax filing and payments | Yes, with each payroll run, taxes are calculated and paid to federal, state, and local agencies at no additional cost. |

| Ability to manage employee benefits | Yes, you can manage medical insurance, health savings accounts, or HSAs, flexible spending accounts, or FSAs, 401(k)s, and more, with payments, automatically deducted from payroll. (Health benefits not available in all states.) |

| Employee access to the portal | Yes, employees have lifetime access to their own account to view pay stubs, obtain W-2 forms and change personal information. Through Gusto Wallet, they can access and manage their money. |

| Live support | Yes. Offers live customer support by phone, email, or chat at all subscription levels. Support is not available on weekends. |

| Ease of use | Yes. Has a user-friendly interface with simple step-by-step tools, checklists, and tutorials. |

Gusto Review: Pricing

It’s almost impossible to know the exact price of some benefits and payroll services. Gusto posts its monthly subscription prices online, but that’s not the case.

Visit Gusto

Core — $6/month per person; $39/month base price

- Full-service payroll is available in 50 states, with direct deposit of two days.

- Unlimited payroll runs, bonus and off-cycle.

- Administration of health benefits

- Paid-time-off policies.

- Integrations for accounting and time-tracking.

- Administration of workers’ compensation.

- Onboarding tools for employees

- Document management and employee offers

Complete — $12/month per individual; $39/month basis price

- Core-tier benefits.

- Next-day direct deposit.

- Time-off requests.

- Time tracking.

- Ability to modify account permissions for employees

- Surveys and employee directory.

- Managers can set permissions to be customized.

Concierge — $12/month per person; $149/month base price.

- Complete-tier benefits.

- Customer support is available 24/7.

- Access to an HR resource center and certified HR professionals

Contractor — $6/month per person; $0/month base price.

- Unlimited contractor payments

- Fill out Form 1099 and submit it.

- Self-service for contractors to view year-end forms and payments.

Is Gusto right for my business?

Gusto’s suitability for your business depends on what features you value most.

Yes, if you need:

- An app that can be accessed from anywhere, cloud-based.

- Unlimited payroll runs in any state

- Contractor payment option with no monthly base fee

- You can cancel at any moment.

- Access to a top-notch employee portal.

- Automated processes and integration of apps

Maybe not, if you need any of these:

- Health benefits in all 50 states.

- Separate mobile payroll app. Roll by ADP, a chat-based mobile payroll app.

- You can deposit same-day. QuickBooks offers same-day direct deposits.

- Monthly fees for contractors and employees of $5 or less (Square, Patriot, and OnPay have lower per-person fees.

What is exactly is Gusto?

Gusto doesn’t charge any setup fees, unlike some competitors. Gusto offers free payroll setup support when you create your first payroll account. You can also complete the 10-step online setup yourself.

Select the right Gusto plan to fit your needs. All plans include integrated payroll, benefits, and HR. Higher tiers offer more customizable features, and Concierge-level provides dedicated support by HR professionals. You can upgrade or downgrade at any time.

Next, you can choose to set up benefits for your employees. Certain benefits, like the Gusto Wallet App, are free. Other benefits, such as 401(k), plans have a monthly cost and per-participant costs (with benefit pricing available at the Gusto site).

Gusto will help you create a benefits package that suits your company’s needs. You can also compare different medical, dental, and vision plans on the app to find the right fit for you (assuming the state offers health benefits administration services). You can also create 401Ks and 529 savings, Health Savings, Flexible Spending, commuter and workers’ compensation, and life and disability insurance.

Tip – Gusto allows you to add benefits that are not offered by other providers. Gusto will take over the administration of your plans when you transfer your health insurance. However, this is not true for 401(k), as Gusto will need to manage those.

Gusto’s Positive Aspects

Gusto is able to assist businesses in building a complete payroll, benefits, and HR process that saves time.

Access to a top-notch employee portal

Gusto allows your employees to take control of many tasks through the Gusto employee portal or the Gusto Wallet app. Onboarding paperwork can be completed by employees, they can choose from the available benefits and access payslips and other records via the portal. This saves you time and helps them save time. Payroll deductions are automatically updated once employees have enrolled in benefits through their accounts.

Employees can also have lifetime access to Gusto accounts as long as they have an email address. Employees can access their Gusto accounts even if they leave the company and need them years later. Many small-business payroll systems don’t allow for lifetime access for former employees.

There are many ways to automate and integrate apps.

Gusto offers many ways to automate HR and payroll tasks. You can have payroll run automatically without additional charges. A reminder will be sent the day before. Gusto will automatically calculate, file, pay, and file your federal, state, and local payroll taxes. It will also report any new hires to the government. Although competitors may offer automation, there are usually additional charges.

Gusto allows you to integrate with much third-party accounting software, such as time tracking, expense management, and point-of-sale, regardless of your plan level. Popular accounting software like FreshBooks, QuickBooks Online, and Xero can be integrated. With Gusto, data can be synced with less effort.

Good customer service

You can get customer support by phone or chat at any subscription level. This includes Gusto’s representatives in San Francisco and Denver. This is a huge advantage, especially for people who are just starting to set up benefits and payroll. However, customer support is not available on weekends.

Gusto offers an extensive online Help Center with step-by-step guides and videos, as well as FAQs.

Gusto’s Negative Aspects

Gusto has a few cons, but you need to be aware of some things.

Certain benefits are not available in every state

Gusto offers payroll services in all 50 US states. However, it has some restrictions regarding its services for commuter benefits, HSAs, FSAs, and health benefits. These benefits should be available in the state you are located if you plan to offer them.

Access to health benefits, FSAs, HSAs, and commuter benefits

No separate mobile app

Gusto doesn’t offer a mobile app that allows you to pay your payroll on the move. Mobile access can be made through a web browser. Some pages may require extra scrolling.

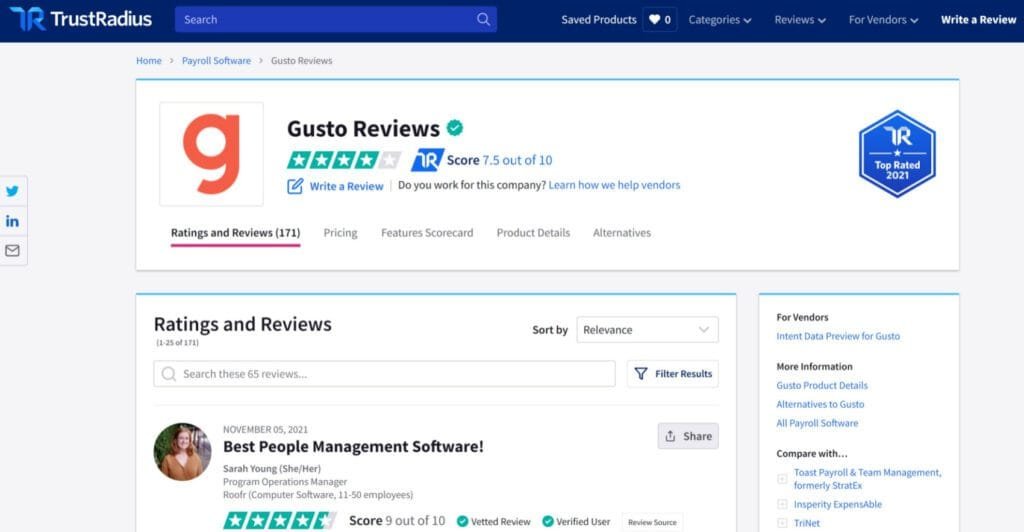

Gusto Customer Reviews

Alternatives to Gusto

| Gusto | Gusto Payroll Plans start at $39 per month (base) and $6 per person per month. |

| ADP | RUN Powered by ADP Plans starts at $59 per month (base) and $4 per person per month. |

| OnPay | OnPay Payroll Plans start at $36 per month (base) and $4 per person per month. |

| Square | Square Payroll Plans start at $35 per month (base) and $5 per person per month. |

| QuickBooks | QuickBooks Payroll Plans start at $45 per month (base) and $4 per person per month. |

| Wave | Wave Payroll Plans start at $20 per month (base) and $6 per person per month. |

| Providers may change their pricing. |

Gusto is known for its strong suite of benefits, payroll, and HR tools. However, it might not be right for everyone. There are many other options.

QuickBooks Payroll: Same-day direct deposit

Gusto allows for next-day direct deposits of employees’ pay at the Complete or Concierge level. Quickbooks payroll offers same-day direct deposits with higher tiers. This means that you can submit your payroll before 7 a.m. PT on payday and your employees will receive their money that day. Gusto can integrate with QuickBooks. If you use Intuit accounting software and tax software, adding QuickBooks payroll may be the next step.

Square Payroll: The same features, but a lower monthly cost

SquarePayroll’s monthly cost is $5 per person, with a $35-per month base price. This compares to Gusto which costs $6 per person and has a $39 per month base price. Square Payroll is similar to Gusto. It does not charge a setup fee and offers features such as the ability to file payroll taxes automatically (but not at the local level), manages employee benefits and complete unlimited payroll runs.