Starting a Limited Liability Company (LLC) in Louisiana is an important milestone, but your business journey doesn’t end there. One key requirement is obtaining an Employer Identification Number (EIN) from the IRS.

This unique nine-digit code is essential for various operations like tax reporting, employing staff, and establishing a business bank account.

In this guide, we’ll take you through the streamlined steps to secure an EIN for your Louisiana LLC, ensuring you meet all federal and state mandates.

Get an EIN Number for a Louisiana LLC

An EIN (Employer Identification Number) is a unique nine-digit number issued by the Internal Revenue Service (IRS) to businesses such as a Louisiana LLC and other entities operating in the state of Louisiana or any other state.

An EIN is also known as:

- Federal Tax ID Number

- Employer Identification Number

- EIN Number

- Federal Employer Identification Number (FEIN)

What is an EIN Used For?

An EIN Number (Federal Tax ID Number) is used to identify businesses for tax purposes, similar to how a Social Security Number identifies individuals.

Here are a few situations that may require you to get an EIN for your Louisiana LLC:

- Hiring Employees: If you plan to hire employees for your Louisiana LLC, you will need an EIN. This number is necessary for reporting taxes and other employment-related obligations.

- Opening a Business Bank Account: Most banks require an EIN to open a business bank account. Having a separate bank account for your Louisiana LLC helps maintain clear financial records and separates your personal finances from your business finances.

- Filing Taxes: An EIN is necessary for filing federal tax returns for your LLC. Even if your LLC is a single-member LLC, it will still require an EIN for tax purposes.

- Applying for Business Permits and Licenses: Many local and state government agencies in Louisiana may require an EIN when applying for specific permits or licenses for your LLC.

When Should I Get an EIN?

After you have formed an LLC (Limited Liability Company), it is generally recommended to obtain an Employer Identification Number (EIN) as soon as possible.

How Much Does an EIN Cost?

Obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) is generally free of charge. The IRS does not charge a fee for issuing an EIN. You can apply for an EIN online through the IRS website or by mail, fax, or phone, and there is no cost associated with the application process.

EIN Services by Northwest

| Need an LLC? Northwest can form your LLC for $39 + state fee, + optional $50 EIN service |

Do Louisiana LLCs Need to Have an EIN?

In Louisiana, businesses, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs), are generally required to obtain an EIN if they have employees or meet certain other criteria, such as withholding taxes on income paid to a non-resident alien. The EIN Number helps the IRS track business activities and ensure compliance with tax laws.

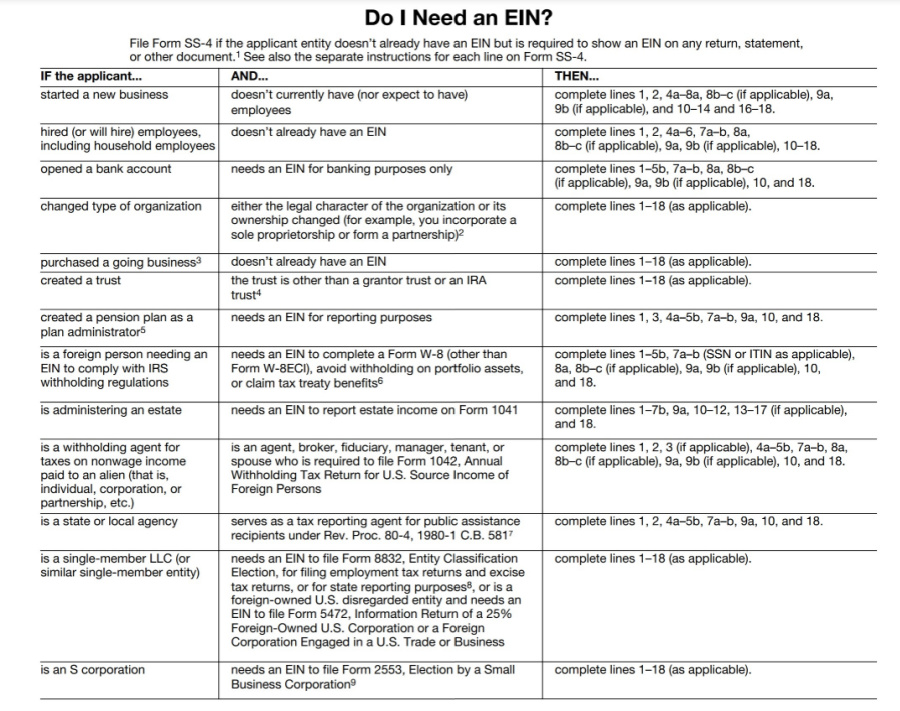

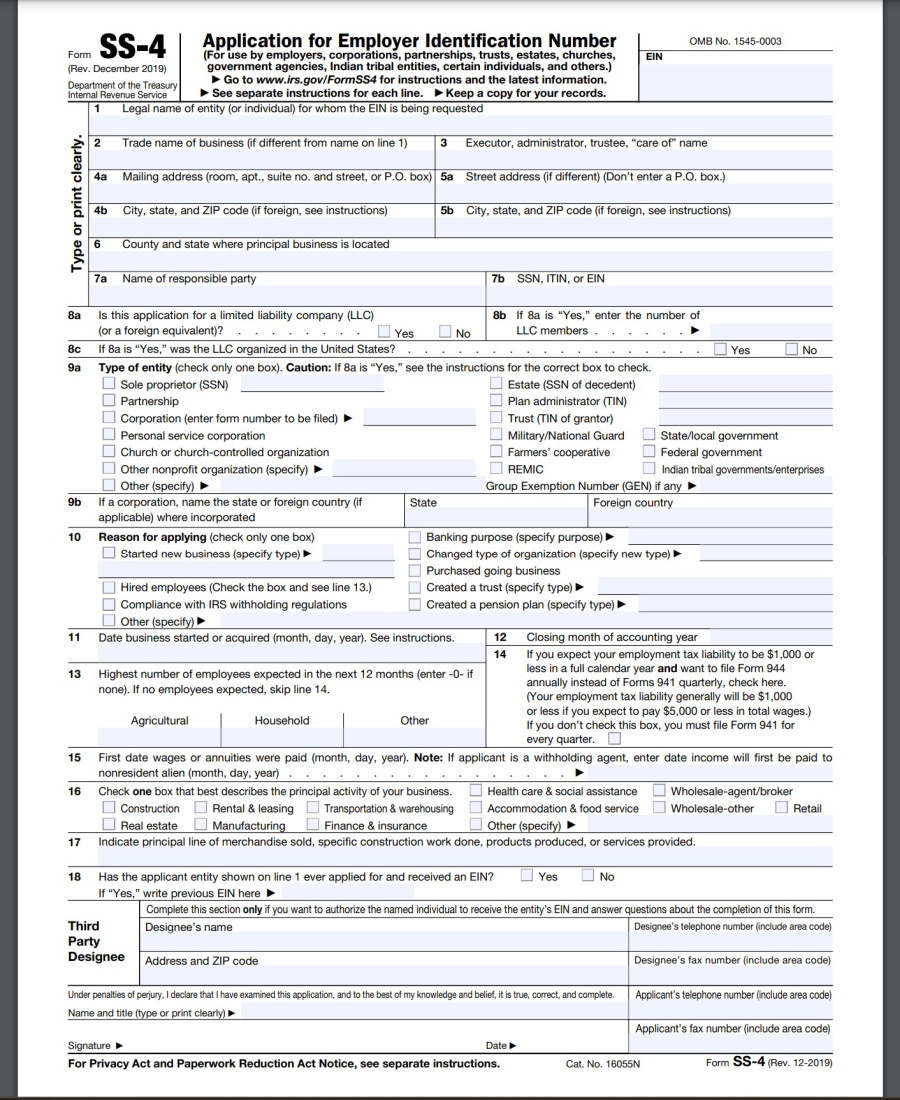

To obtain an EIN Number in Louisiana, businesses can apply directly with the IRS by completing Form SS-4 (Application for Employer Identification Number). The application can be submitted online, by mail, or by fax.

Alternatively, businesses can authorize a third-party, such as an accountant, tax professional, or LLC service like Northwest Registered Agent to apply for an EIN on their behalf.

It is important for businesses in Louisiana to obtain an EIN Number to fulfill their tax obligations and ensure proper identification for their business entity.

Does a Single Member LLC in Louisiana Need to Get an EIN Number?

A single-member Louisiana LLC (Limited Liability Company) is generally not required to obtain an EIN (Employer Identification Number) if it has no employees and operates as a “disregarded entity” for tax purposes.

A single-member LLC will need an EIN if you plan to:

Open a Business Bank Account: Many financial institutions require an EIN to open a business bank account. An EIN acts as a unique identifier for the business when conducting financial transactions, including obtaining a business credit card or getting a business loan.

Having a business bank account helps prevent confusion between personal and business finances and ensures that financial records are appropriately attributed to the entity. Having a separate business bank account also simplifies accounting and facilitates the tracking of business income and expenses.

Single-member Louisiana LLC: Here are a few key points to consider

- Default Tax Classification: By default, a single-member LLC in Louisiana is treated as a “disregarded entity” for federal tax purposes. This means that the IRS does not recognize the Louisiana LLC as a separate entity, and the owner reports the business income and expenses on their personal tax return using their Social Security Number (SSN).

- Use of SSN: The owner of a single-member LLC can use their SSN for tax and reporting purposes, similar to a sole proprietorship. The business income and expenses are reported on Schedule C (Profit or Loss from Business) of their personal tax return (Form 1040).

- Exceptions and Changes: There are certain situations where a single-member LLC in Louisiana may need an EIN, such as if the LLC has employees, is required to file certain federal excise tax returns, or chooses to be taxed as a corporation. Additionally, if the single-member Louisiana LLC later adds additional members, it will be required to obtain an EIN.

Visit the IRS: https://www.irs.gov/businesses/small-businesses-self-employed/single-member-limited-liability-companies

How Do I Apply for an EIN Number for a Louisiana LLC?

Here is a step-by-step guide on how to apply for an EIN number:

1. Determine Eligibility: Before applying for an EIN number (federal tax ID number), make sure you are eligible. EINs are typically required for businesses, including sole proprietorships, partnerships, corporations, and LLCs. Certain entities, such as trusts, estates, and non-profit organizations, may also need an EIN.

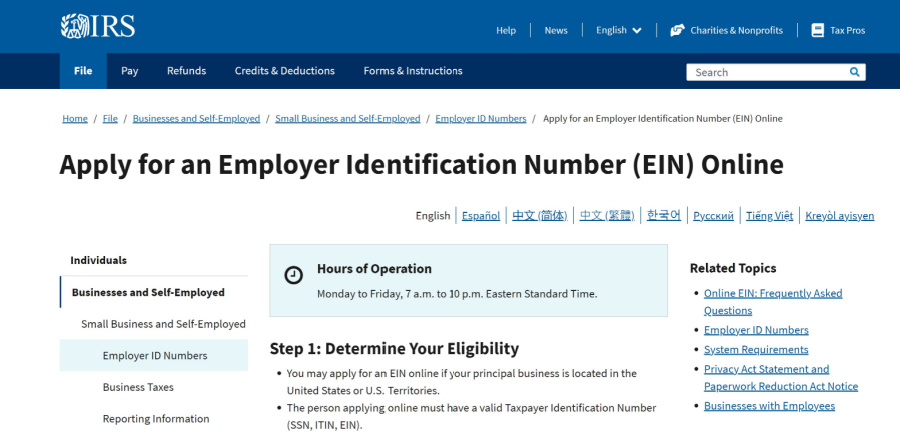

2. Access the Online Application: The quickest and easiest way to apply for an EIN number is through the online application on the Internal Revenue Service (IRS) website. Go to the IRS website and search for “EIN application” or directly visit the “Apply for an Employer Identification Number (EIN)” page.

3. Choose the Appropriate Application Type: The online application will present different options for application types. Select the one that best suits your situation. Common options include “Sole Proprietor,” “Partnership,” “Corporation,” “LLC,” and “Non-Profit Organization.”

4. Provide Required Information: Fill out the online application form with accurate information. You will be asked to provide details about the business entity, such as the legal name, address, and type of organization.

Additionally, you’ll need to provide the name and Social Security number or Individual Taxpayer Identification Number (ITIN) of the responsible party, who is typically the owner or principal officer.

- IRS EIN Online Application: https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

- Form SS-4 (Application for Employer Identification Number): https://www.irs.gov/pub/irs-pdf/fss4.pdf

5. Review and Submit the Application: Double-check all the information you have entered to ensure its accuracy. Once you are satisfied, submit the application electronically. The system will validate the information, and upon successful submission, you will receive your EIN immediately.

6. Print or Save the Confirmation: After receiving your EIN, it is advisable to print or save the confirmation notice for your records. This notice serves as proof of your EIN and can be used for various purposes, such as opening bank accounts or filing tax returns.

7. Understand Additional Requirements: Depending on the nature of your business and state regulations, there may be additional requirements to fulfill, such as obtaining state-level tax identification numbers. Research the specific requirements for your business to ensure compliance.

Federal Tax ID Number Confirmation Letter

Confirmation Letter: Once your EIN is assigned, the IRS will provide you with a confirmation letter. The confirmation letter serves as official documentation of your EIN and includes your entity’s name, address, and the assigned EIN. The letter typically arrives by mail and can take several weeks after receiving your EIN.

Remember to keep a copy of your EIN and confirmation letter in a safe place, as you may need it for various tax-related purposes, such as opening a business bank account or filing tax returns.

Note: If you prefer not to apply online, you can complete Form SS-4, the Application for Employer Identification Number, and submit it by mail or fax to the appropriate IRS office. The processing time for mail or fax applications is longer compared to the online application.

EIN Number vs. Social Security Number: Key Differences

An EIN Number (aka Federal Tax ID Number) and Social Security Number (SSN) are both identification numbers used in the United States, but they serve different purposes and are assigned to different entities. Here are the key differences between EIN Numbers and Social Security Numbers:

1. Purpose:

– EIN Number: An EIN is primarily used to identify businesses, nonprofit organizations, estates, trusts, and other entities for tax purposes. It is issued by the Internal Revenue Service (IRS) and is required for various business-related activities such as filing taxes, hiring employees, and opening business bank accounts.

– Social Security Number: A Social Security Number is a unique nine-digit number issued by the Social Security Administration (SSA) to individuals. It is primarily used for tracking an individual’s earnings and contributions to the Social Security system, determining eligibility for government benefits, and for identification purposes.

2. Entity Type:

– EIN Number: EINs are assigned to business entities, including sole proprietorships, partnerships, corporations, limited liability companies (LLCs), and nonprofit organizations. It is not assigned to individuals unless they are operating a business entity or have specific tax requirements.

– Social Security Number: Social Security Numbers are assigned to individual persons. They are used to track an individual’s employment history, eligibility for Social Security benefits, and for personal identification in various contexts.

3. Issuing Authority:

– EIN Number: EINs are issued by the IRS. Businesses and entities can apply for an EIN through the IRS either online, by mail, or by fax.

– Social Security Number: Social Security Numbers are issued by the Social Security Administration (SSA). They are typically assigned to individuals when they apply for a Social Security card through the SSA.

4. Usage:

– EIN Number: EINs are primarily used for business and tax-related purposes. They are used when filing business tax returns, paying employment taxes, opening business bank accounts, applying for business licenses, and conducting various business-related transactions.

– Social Security Number: Social Security Numbers are used for personal identification and tracking of an individual’s earnings and contributions to the Social Security system. They are required for employment purposes, filing personal tax returns, applying for government benefits, obtaining loans, and other personal financial transactions.

5. Confidentiality:

– EIN Number: EINs are generally considered public information. Once assigned, EINs can be searched and verified by the public through various sources, such as the IRS Business Entity Search tool.

– Social Security Number: Social Security Numbers are considered sensitive and confidential personal information. They should be protected and shared only when necessary for authorized purposes to prevent identity theft and fraud.

It’s important to understand the differences between EIN Numbers and Social Security Numbers to ensure their proper usage and protect personal and business information.

How to Change or Update an EIN Number for Your Louisiana Business

Changing or updating an EIN (Employer Identification Number) for your Louisiana business typically involves updating the business’s legal and tax information with the Internal Revenue Service (IRS). Here’s a brief overview of how to change or update an EIN number:

1. Understand the Need for Change:

Determine the reason for the change. Common reasons include changes in business structure (e.g., from a sole proprietorship to an LLC or corporation), changes in ownership, or errors in the initial EIN application.

2. Notify the IRS:

Contact the IRS Business and Specialty Tax Line at 1-800-829-4933 to inform them of the desired changes. Explain the reason for the change and provide any necessary documentation to support the request.

3. Obtain Necessary Forms:

Depending on the type of change, you may need to complete and submit specific IRS forms. For example:

– Change in business structure: File the appropriate form to reflect the new structure, such as Form 8832 (for LLCs) or Form 2553 (for S-corporations).

– Change in ownership: File Form 8822-B (Change of Address or Responsible Party – Business) to update the responsible party information.

4. Update Business Records:

Ensure that your business records, including licenses, permits, and financial accounts, are updated with the new EIN and any other relevant changes.

5. Notify Other Agencies and Entities:

Inform other relevant entities and agencies of the EIN change, such as state tax authorities, banking institutions, and business partners.

It’s crucial to consult the IRS and possibly seek professional advice to ensure compliance with the appropriate procedures and requirements for changing or updating an EIN.

Links for Changing or Updating Information:

1.

2. IRS Change of Address or Responsible Party – Business (Form 8822-B): https://www.irs.gov/forms-pubs/about-form-8822-b

FAQs

Can Non-U.S. Residents Apply for an EIN for Their Louisiana LLC?

Yes, non-U.S. residents can apply for an EIN for their Louisiana LLC. Unlike a Social Security Number (SSN), you don’t need to be a U.S. citizen or resident to obtain a Federal Employer Identification Number (FEIN).

Non-U.S. residents can apply using an Individual Taxpayer Identification Number (ITIN) or other valid forms of identification. The application process generally remains the same, and you can submit Form SS-4 to the Internal Revenue Service (IRS).

This is especially important if you are engaging in business operations within the United States, even if you are not a citizen.

What Happens If I Fail to Obtain an EIN for My Louisiana LLC?

Failing to obtain an EIN for your Louisiana LLC can lead to a variety of complications. The most immediate issue is that you will not be able to open a business bank account, as most financial institutions require an EIN for business accounts.

Furthermore, you will face difficulties in tax filing with the IRS, which could result in fines and penalties. An EIN is also necessary if you plan to hire employees or need to submit various tax forms like W-2 or 1099 Forms.

Moreover, not having an EIN could make your business non-compliant with both federal and Louisiana state regulations, which might jeopardize your business license and could result in legal issues. Therefore, it’s crucial to get your EIN as part of setting up your LLC.

References and Links from the IRS

Limited Liability Companies (LLCs)

Employer ID Numbers

Apply for an EIN Online

Single-Member Limited Liability Companies (LLCs)

Remember to consult a tax professional or visit the official IRS website for the most up-to-date and accurate information regarding the application process for an EIN number.